The Age Without Cash: Is It Really Coming?

Part 4. The Web 3.0 Trend: Heard of It, Never Fully Understood It

Columnist

You Yeondong Amorepacific New Digital Business TF

#Blockchain #CBDC #CentralBankDigitalCurrency

Thumbnail Source: Techdigipro

Do you only associate blockchain with investment or speculation? Unbeknownst to many, blockchain technology is being integrated across various industries. In our industrial landscape, finance is the sector where blockchain finds its most vigorous application. Financial authorities and institutions are driving the adoption of blockchain-based innovations such as CBDC, STO, and custody services to construct a revolutionary financial system. Today, let's delve into the CBDC project, a venture to replace conventional currency.

South Korea:

The Choice of the Bank

for International Settlements

The Bank for International Settlements (BIS), often called the world's central bank, has set its sights on South Korea.

On October 5th, the Bank of Korea and financial regulators announced a collaborative effort with the BIS to pilot a CBDC. The BIS has chosen the tech powerhouse as a partner to expedite research and experiments on CBDC. This year, the initiative is focused on recruiting institutional participants, with plans to develop a system that the general public can use, by next year's fourth quarter.

Source: MBC

So, what exactly is a CBDC (Central Bank Digital Currency)? It's a digital currency issued by central banks, designed to address the flaws of traditional coins and paper money by transitioning to a digital format. While it may seem unfamiliar to us, over 90% of central banks worldwide are considering its adoption, with half already conducting tests.

South Korea is the first country to advance CBDC testing in cooperation with the BIS. If successful, this test could accelerate the emergence of a cashless world, not just in South Korea but globally. The concept of a government-led token used for deposits and payments, breaking away from the narrow view of “blockchain=Bitcoin” or “blockchain=investment,” is truly astounding.

In this column, we'll dive deeply into the blockchain-powered CBDC. Be warned, the content can be pretty intricate. To ease understanding, I've categorized it into ‘Mild’ (more straightforward content) and ‘Spicy’ (complex content) sections for your convenience :)

CBDC Mild

1 Do we really need electronic currency when we're doing fine with paper money?

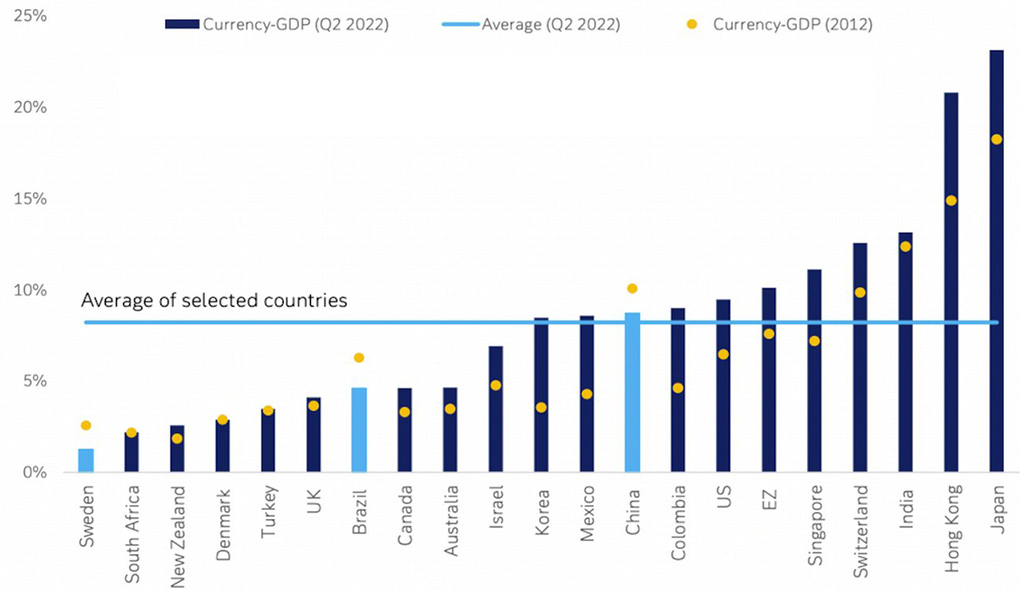

The declining use of cash is a direct motivation for central banks worldwide to consider implementing CBDCs. According to Deutsche Bank Research, Sweden's cash usage as a percentage of Gross Domestic Product (GDP) is currently at 1%. South Korea shows a cash usage rate close to the global average, at 7%.

Source: Deutsche Bank, Haver Analytics

However, the annual cost of currency circulation is substantial. In South Korea, over 1 trillion won in currency is discarded annually, with hundreds of billions incurred each year in reissuing and circulating currency. Given the ongoing decline in cash usage, preparing for a cashless society seems a logical next step.

From the government's perspective, the appeal of CBDCs lies in the transparency of money flow. Unlike cash, which is difficult to track, CBDCs can be coded with unique identifiers, making it possible to trace where the money is spent. This feature could be instrumental in curbing illegal fund formation, money laundering, tax evasion, and other criminal activities.

Lastly, CBDCs offer advantages in terms of efficient fiscal execution. Take disaster relief funds, for instance. The intended economic stimulus is weakened if these funds are saved instead of spent. However, if disbursed as CBDC, they can be programmed for specific uses to increase the policy effectiveness.

2 What benefits do CBDCs offer ordinary citizens, aside from the government?

In a country like ours, where card and payment systems are advanced, it's questionable whether CBDCs can provide a groundbreaking financial experience to the general public. However, they seem promising for small business owners. CBDCs can lower payment processing fees by reducing reliance on intermediaries and enable immediate receipt of funds without needing a separate settlement process.

When a credit card is used for payment, the card company purchases the sales slip and deposits the amount into the seller's account after three business days. This three-day gap can pose a significant risk for small business owners with limited capital. The near-real-time receipt of funds with CBDCs is expected to aid in liquidity management for small businesses and others.

Globally, financial inclusivity is touted as one of the most significant advantages of CBDCs. Financial inclusion refers to the ease with which economic entities can access financial services such as payments, deposits, loans, and insurance through financial institutions. In developing countries and some regions of developed nations, a high percentage of people need bank accounts due to underdeveloped banking sectors. CBDCs are seen as a potential solution to this issue.

3 Are there any concerns to be aware of?

The most significant concern is anonymity. The prospect of recorded transactions, like card purchases, raises privacy concerns. Some fear that this could lead to government control over all economic activities of its citizens. While this issue could be addressed through zero-knowledge proofs, which allow for encryption without revealing specific transaction details, it still leaves an uncomfortable feeling.

On a personal note, losing the romanticism associated with cash is a regrettable aspect. Cultural practices like receiving cash during the Lunar New Year celebrations or secretly keeping emergency funds away from the knowledge of parents or spouses could become nostalgic memories of the past.

*Zero-Knowledge Proof: An encryption scheme where the ‘prover’ can convince the ‘verifier’ that they know specific information without revealing it.

CBDC Spicy

This section gets more complex. Understanding up to the ‘Mild’ level is sufficient for those new to CBDC. Those interested in a deeper dive into CBDC read on.

4 How is the Korean-style CBDC structured?

CBDCs are differentiated into retail and wholesale types based on their scope of use and the users involved. Retail CBDCs are like cash, directly issued to economic agents for use in everyday transactions. In contrast, wholesale CBDCs are akin to bank reserves issued by financial institutions for interbank transactions and final settlements.

Banks currently use deposits in accounts opened with the Bank of Korea, i.e., reserves, for transactions and settlements between banks. Digitally transitioning is the crux of establishing a wholesale CBDC infrastructure.

Source: KBS

Initially, Korea plans to focus on testing wholesale CBDCs. This is expected to facilitate more rapid interbank payments and settlements. Small interbank transactions are currently conducted using a ‘deferred net settlement’ system. This involves inherent credit risks when transactions exceed the actual owned funds. The introduction of CBDCs is expected to resolve this issue.

*Deferred Net Settlement: The process where the net amount from transactions exchanged during a day is settled by the Bank of Korea through the financial network at 11 a.m. the following day.

5 What currencies are issued within the CBDC network?

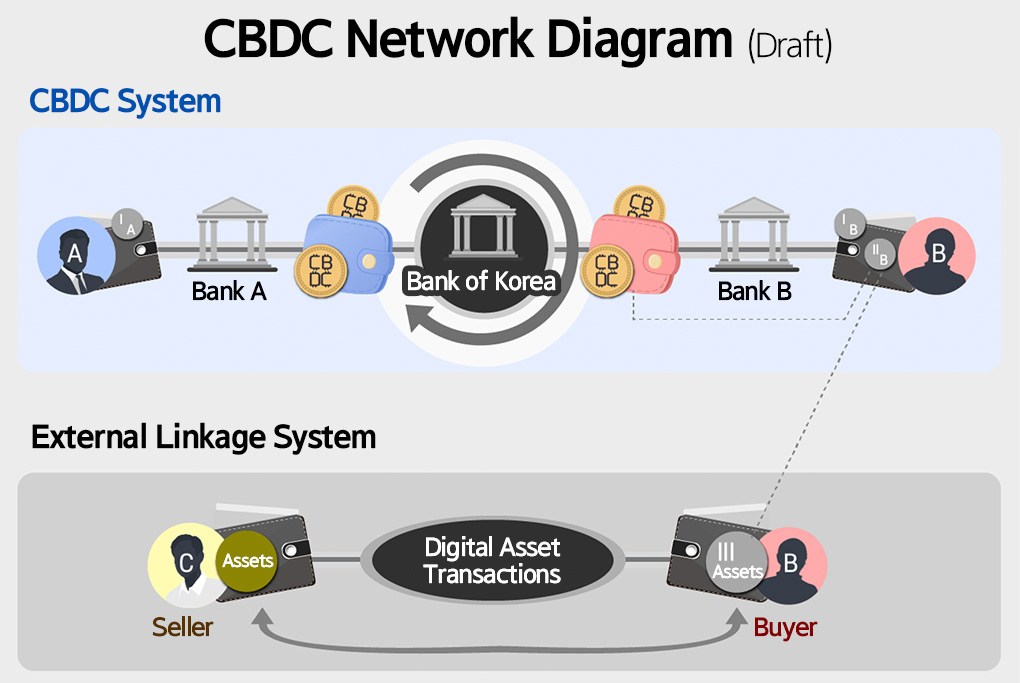

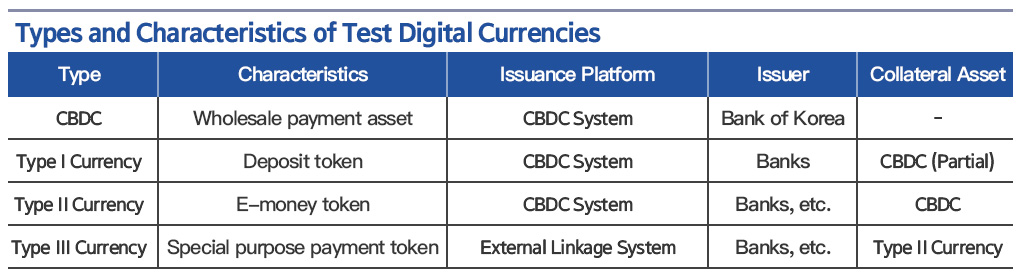

According to a report by the Bank of Korea, the CBDC network comprises the CBDC system and an external linkage system, within which a wholesale CBDC and three types of private digital currencies are issued.

Source: Joint Report by the Bank of Korea and BIS

The CBDC system serves as a platform where the wholesale CBDC and digital currencies Type I and II are issued and circulated, accessible only to authorized financial institutions.

The Bank of Korea issues the CBDC as a wholesale payment asset, while Type I currency is a token issued by banks, akin to current deposits, and backed by CBDC at the current reserve requirement ratio.

Type II currency is an e-money token issued by financial institutions, backed by 100% of the corresponding wholesale CBDC as collateral. This concept is similar to the current form of electronic money.

The external linkage system is a separate platform where specific digital assets, including special-purpose payment tokens, are issued and circulated. These tokens are issued with 100% backing of Type II currency within the CBDC system.

In summary, banks currently use the deposits in accounts opened with the Bank of Korea, i.e., reserves, for transactions and settlements. With the Bank of Korea issuing wholesale CBDC, financial organizations will use deposit tokens linked to this as a means of payment and settlement. Bank customers will open deposit token accounts, similar to brokerage accounts for stock trading.

*Electronic Money: A digital currency used for online purchases, utility payments, and transfers, typically issued by financial institutions and accessible via mobile apps or digital platforms. Examples include NAVER Pay, Samsung Pay, and Kakao Pay.

*External Linkage System: A separate platform where specific digital assets are issued and circulated and Type III digital currency, used for payments in digital asset transactions, is issued.

6 Could Stablecoins be an Alternative to Deposit Tokens?

Until the recent unveiling of this blueprint, there was market speculation that private stablecoins could be utilized in the CBDC framework. However, it's speculated that financial authorities opted for deposit tokens due to inherent limitations in stablecoins.

Primarily, private stablecoins are issued in a bearer certificate format, granting claim rights to the holder. Consequently, the issuer's balance sheet remains unchanged until redemption. This poses the risk of the stablecoin being traded at a discount from its face value in cases of trust issues.

Historically, there's precedent for this concern. During America's Free Banking Era, privately issued bank currencies, also issued as bearer certificates, were traded at discounts of up to 20%. More recently, the blockchain market witnessed presumed safe stablecoins being issued at discounted prices, eroding market trust.

In contrast, deposit tokens operate similarly to the current two-tier banking system, where the amount deducted from the payer's deposit account is credited to the payee's account. Based on CBDC, this dual-currency system allows for transactions to be protected by financial regulations and supervision, as well as the safety mechanisms of the central bank. The existing regulatory framework for deposits is anticipated to apply broadly, facilitating a smooth transition.

Source: Taming Wildcat Stablecoins

So, what about the future of stablecoins? In 2021, Federal Reserve Board member Jeffrey Zhang and Yale Professor Gary B. Gorton published a paper titled ‘Taming Wildcat Stablecoins.’ They propose three scenarios worth considering:

① Treating stablecoin issuers as banks and applying similar regulations, such as deposit insurance.

② Legislating stablecoin issuers to back stablecoins with U.S. Treasuries or central bank reserves, ensuring a 1:1 guarantee of their face value.

③ The central bank directly issues digital currency and gradually phases out private stablecoins through taxation.

This time, we explored the Central Bank Digital Currency (CBDC). Blockchain technology is gradually permeating our lives. While those of us in the beauty industry don't need to grasp every detail, it's beneficial to be aware of such rapid changes in the world.

Thank you for staying with me through this complex topic. Next time, I'll return with a lighter subject :)

-

Like

0 -

Recommend

1 -

Thumbs up

0 -

Supporting

0 -

Want follow-up article

0