Invest in Your Favorite Artists

Part 5. The Web 3.0 Trend: Heard of It, Never Fully Understood It

Columnist

Yoo Yeondong Amorepacific New Digital Business TF

#STO #TokenSecurities #Blockchain

Source: NewJeans Official Website

Who also thought that

NewJeans would hit it big?

Raise your hand!

We often encounter friends with exceptional intuition. One of my friends is just like that – a dessert aficionado who is the first to try any new dessert at hotels, convenience stores, or even on the streets. Last year, we tried Tanghulu before it became a massive trend in Korea. Unlike me, who underestimated it for its excessive sweetness, my friend, despite not favoring it personally, confidently predicted its imminent success...

Source: Marie Claire

In the entertainment industry, such intuitively gifted ones are not uncommon. Long-time idol fans claim to recognize potential from the very beginning. One such idol group that caught early attention is NewJeans. Even I, not well-versed in idol culture, remember getting excited simply hearing that Min Hee-jin, a star director at SM, joined HYBE to make a girl band.

Source: NAVER Data Lab

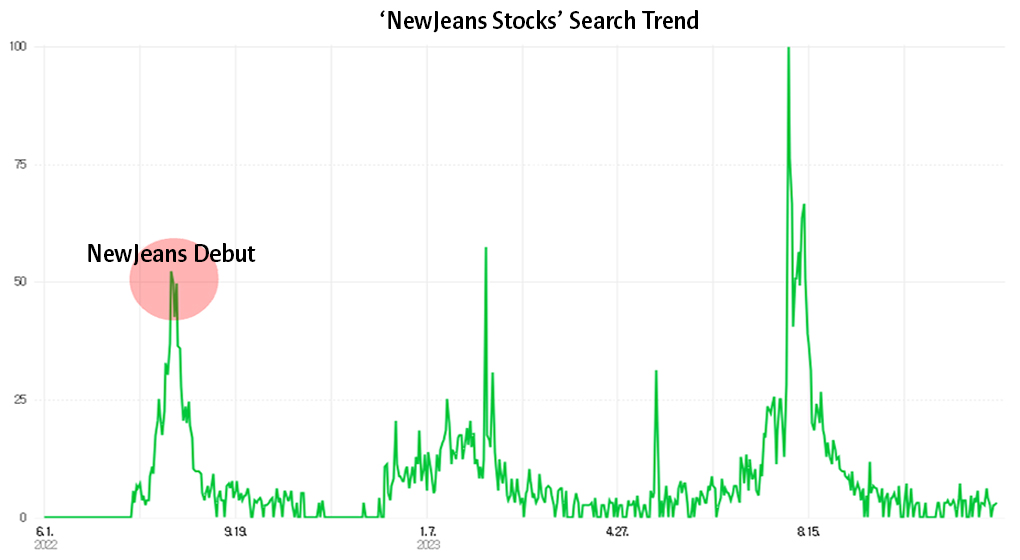

It was around July 2022. Being keen on investments, I belatedly searched on NAVER for ‘NewJeans stocks’ and ‘ADOR stocks’ ahead of NewJeans' debut. (The surge in the search volume in July 2022 shows I wasn't alone in this thought.) However, I soon discovered that ADOR, the company behind NewJeans, is a subsidiary of HYBE and does not have publicly traded stocks.

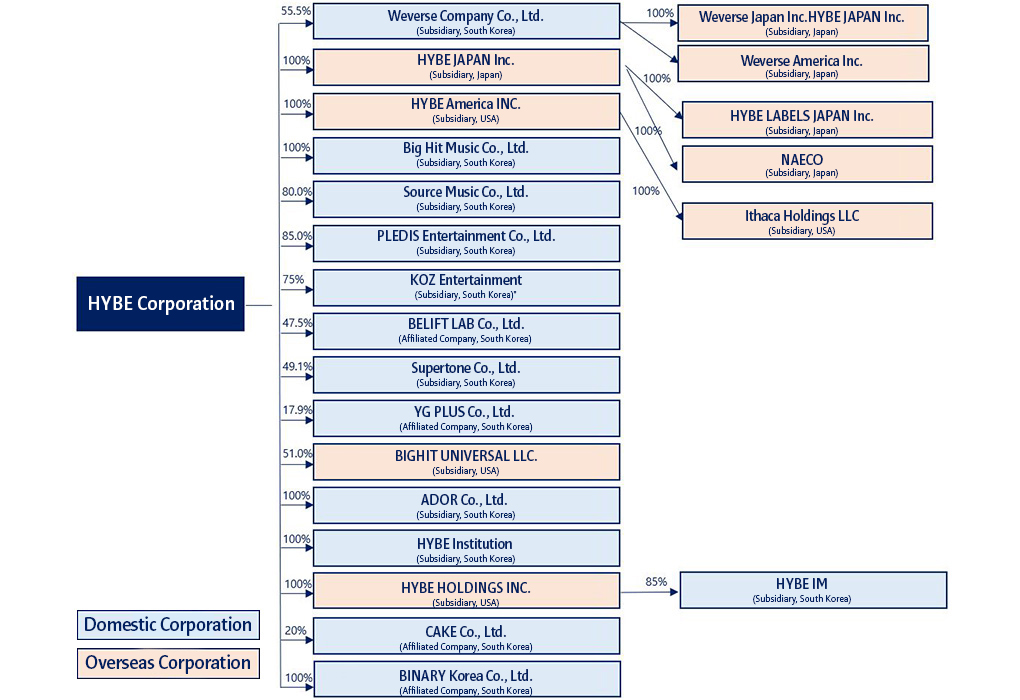

Realizing there was practically no way to acquire a stake in ADOR, I realized that directly investing in NewJeans was impossible. Investing in HYBE stocks in anticipation of NewJeans' success seemed unfeasible; HYBE has too many subsidiaries, and ADOR's share appeared insignificant. Although I was confident about NewJeans' potential, I was disappointed by the lack of a direct investment avenue.

Source: 2023 HYBE Business Report

Looking ahead, direct investment in NewJeans appears set to become a reality. Furthermore, it's not just NewJeans itself but their songs that will open up for investment. If you sense a hit in their song “Super Shy,” for example, you could directly invest in it. This opportunity arises thanks to STO – a revolutionary financial system that securitizes various assets and rights that were previously difficult to assetize.

What is STO?

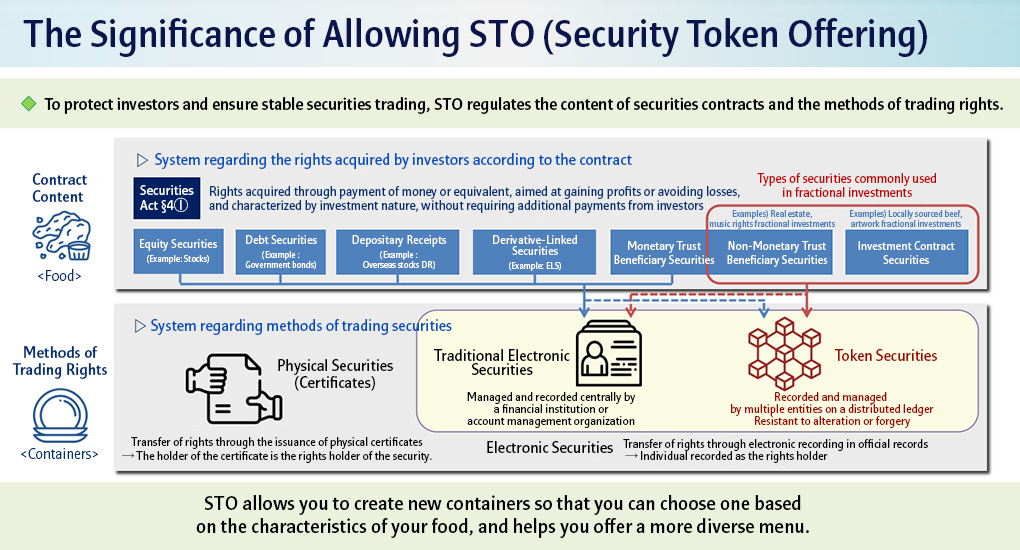

STO is an abbreviation for Security Token Offering, which involves issuing digitized securities based on distributed ledger technology. Sounds complex, especially if you're unfamiliar with financial terminology, right? Let's break it down, term by term.

1 The Birth of a New Security

To grasp STO, one must first understand securities. Securities represent ‘rights with monetary value.’ While this definition may seem complex, they are simply stocks or bonds. Delving deeper, there are six types of securities under the Capital Market Act: debt securities (bonds), equity securities (stocks), depositary receipts (DRs), derivative-linked securities (ETNs), beneficiary securities (monetary trusts = funds, non-monetary trusts), and investment contract securities.

Beneficiary securities (non-monetary trusts) and investment contract securities are atypical in nature, making them challenging to encapsulate in traditional electronic securities. As such, they have never been issued in Korea. However, with the emergence of various non-standardized products, the demand for token securities capable of encapsulating these two types of securities is increasing.

Source: Financial Services Commission STO Policy Direction Report

2 Why Tokens?

The securities depository system in Korea has been in place since 1974, initially involving physical, paper-based securities. Fast forward 45 years to 2019, and these paper securities have vanished into history, replaced by electronic securities. Now, preparations are underway to utilize token securities for products that are challenging to encompass in electronic securities.

While electronic and token securities have many similarities, they differ significantly. Electronic securities are processed on centralized ledgers, whereas token securities operate on distributed blockchain networks. Customers might feel a slight difference, but the technological approach is distinct. To put it metaphorically, it's like choosing which type of container – physical, electronic, or token securities – to hold each of the six types of securities.

3 The Progress of Domestic and International Token Securities

Recently, there was big news in the securities market. On December 18, 2023, Korea's first investment contract security was issued. The first of its kind was for artwork, specifically a piece by Japanese artist Yayoi Kusama titled “Pumpkin,” valued at over 1.2 billion won. Such high-value art has yet to be available for the average person to purchase or invest in. However, investing in high-value artworks through fractional investments has now become possible, starting from units of 100,000 won. This development has allowed the general public to invest in previously out-of-reach high-value assets.

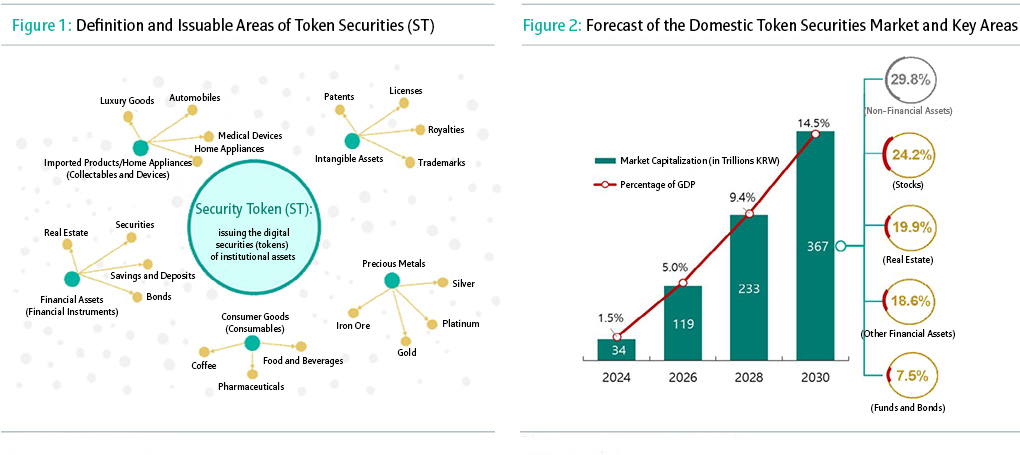

Domestic securities firms are accelerating their STO preparations to take advantage of this opportunity. Most declare STO as a future revenue source and pursue new business ventures. Initially, they are focusing on high-value assets like real estate and art. However, the scope of STO is expanding to include IPs, influencers, and projects that were previously challenging to invest in directly. Not only NewJeans but also famous beauty influencers can become investment targets. Assets appealing to the Millennials and Gen Z are expected to be tokenized and introduced as new products.

Source: Maeil Business News Korea

Globally, various STO cases have already emerged. Siemens, Germany's second-largest corporation by market capitalization, issued bonds on a public blockchain. Without the assistance of clearinghouses and investment banks, the company issued 60 million euros (approximately 86.1 billion won) in digital bonds, saving considerable costs and time compared to traditional bonds. The world's first government-level tokenized green bond was issued in Hong Kong, amounting to 800 million Hong Kong dollars (about 135 billion won), among other diverse use cases.

STO is

Not the Future,

It's the Present

Larry Fink, CEO of BlackRock, the world's largest asset manager, wields formidable influence in the global financial sector, having been instrumental in shaping the ESG global trend. In his annual letter to shareholders this year, he appraised STO as a new wave that will shake the foundation of the financial investment market. He further articulated that STO would enhance the efficiency of the capital market and improve both cost and investment accessibility, expressing the idea that ‘STO is not the future; it is the present.’

Predictions from domestic financial experts concur. Hana Financial Investment Institute forecasts that the domestic token security market will reach 367 trillion won by 2030, accounting for 14.5% of the national GDP. Major domestic securities firms are already advancing the internalization of token security businesses through infrastructure development and acquisitions of related companies. Furthermore, financial firms, big tech, and general enterprises are swiftly entering the market, heightening expectations for the token security market.

Source: Hana Financial Investment Institute

Significant changes are also anticipated in the beauty industry. Internal startups incubated with company funding will be able to receive external investments through token securities. Campaign-based approaches are also feasible. For instance, a global IMC campaign conducted by Sulwhasoo could attract investments from global customers. The beauty industry is expected to introduce creative products that customers (investors) and brands can enjoy together.

Today marks the last session of “The Web 3.0 Trend: Heard of It, Never Fully Understood It.” I've discussed complex topics up until the end, and I thank you for staying with me throughout. If you have any questions about Web 3.0, feel free to reach out anytime. I'm always ready for a comfortable conversation :)

-

Like

0 -

Recommend

0 -

Thumbs up

4 -

Supporting

0 -

Want follow-up article

0