Columnist

So Hyeon Ko AMAZON Team

#INTRO

Retinol Serum Over Anti-Aging Serum

Growing up watching my mom’s vanity overflow with IOPE retinol products, the equation ‘anti-aging = retinol1)' became ingrained in me pretty early on. At some point, ‘retinol serum’ became more familiar to me than the term ‘anti-aging serum.’ But this shift isn’t just about retinol anymore. As more consumers become deeply invested in skincare and expect immediate results, they’re increasingly seeking out products with specific ingredients that directly address their desired ‘effects.’ This trend is unmistakably evident on Amazon. Brands are zeroing in on key ingredients that deliver specific benefits and actively pushing content that showcases dramatic before-and-after results.

This might be one of the driving forces behind K-Beauty’s widespread appeal. While customer expectations for skincare benefits—anti-aging, hydration, and skin tone improvement—remain relatively limited, the ingredients that deliver them are virtually endless. K-Beauty brands excel at introducing these ingredients to consumers and building massive ingredient-keyword markets around them. Within the ingredient markets that have formed on Amazon, I’d like to highlight a few that are less well-known than retinol or niacinamide2) but are experiencing rapid growth.

1) A form of vitamin A known for helping to reduce wrinkles and improve skin elasticity; a key anti-aging ingredient

2) A form of vitamin B3 known for improving skin tone and strengthening the skin barrier

1 Tranexamic Acid / TXA

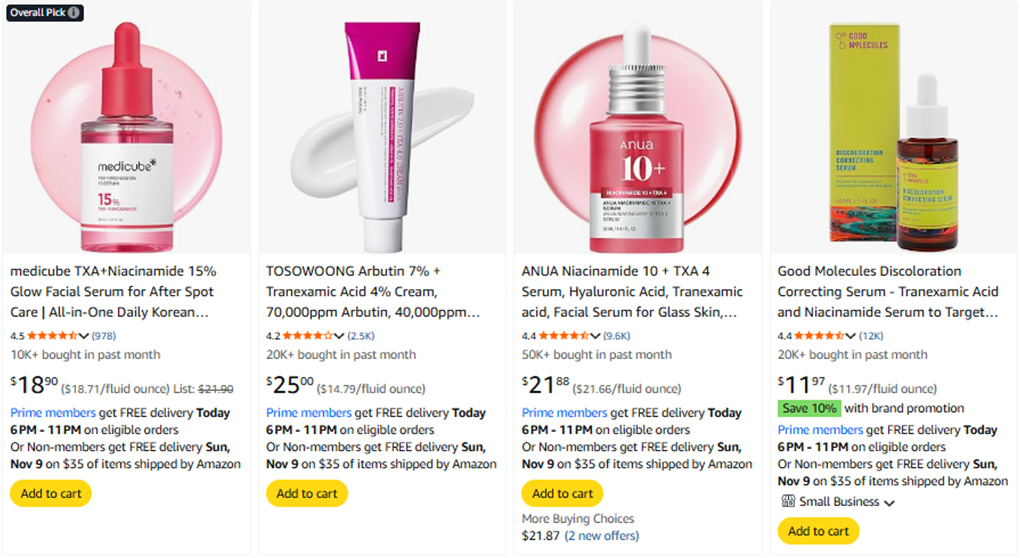

Major tranexamic acid products currently sold on Amazon

While it’s a relatively unfamiliar ingredient, ‘Tranexamic Acid Serum’—a leading search term—ranks within the top 20 searches on Amazon, indicating fairly strong consumer awareness. Known for inhibiting melanin production and helping to address dark spots and hyperpigmentation, this ingredient serves as the hero ingredient in Amazon products targeting blemish care, pigmentation, and skin tone improvement. Related keyword searches grew 121.7%, with the flagship keywords ‘Tranexamic Acid’ and ‘TXA Serum’ showing robust growth of 230% and 480%, respectively, compared to the same period in 2024.

Leading brands include ANUA, Medicube, TOSOWOONG, Good Molecules, and Naturium, with the top five products capturing over 83.1% of total clicks. The price range spans $8 to $25, positioning this as a relatively mid-to-low-priced market. While products are fairly evenly distributed across price tiers of $8–13, $14–19, and $20–25, the $8–13 range accounts for 64% of clicks. In other words, while the market has clear leaders that could make entry challenging, there’s no overcrowding in any single price tier, and products in the $8–13 range are capturing over 65% of clicks and purchases—suggesting potential opportunities at this price point.

In ingredient markets built on expectations of tangible results, dramatic before-and-after content is just the baseline—you need additional differentiation. One approach is combining the ingredient with other, more familiar ingredients that share similar benefits, which not only reinforces efficacy claims but also lowers entry barriers. That’s why major products in the tranexamic acid market often include niacinamide to emphasize pigmentation improvement while simultaneously gaining exposure in the much larger niacinamide market—killing two birds with one stone.

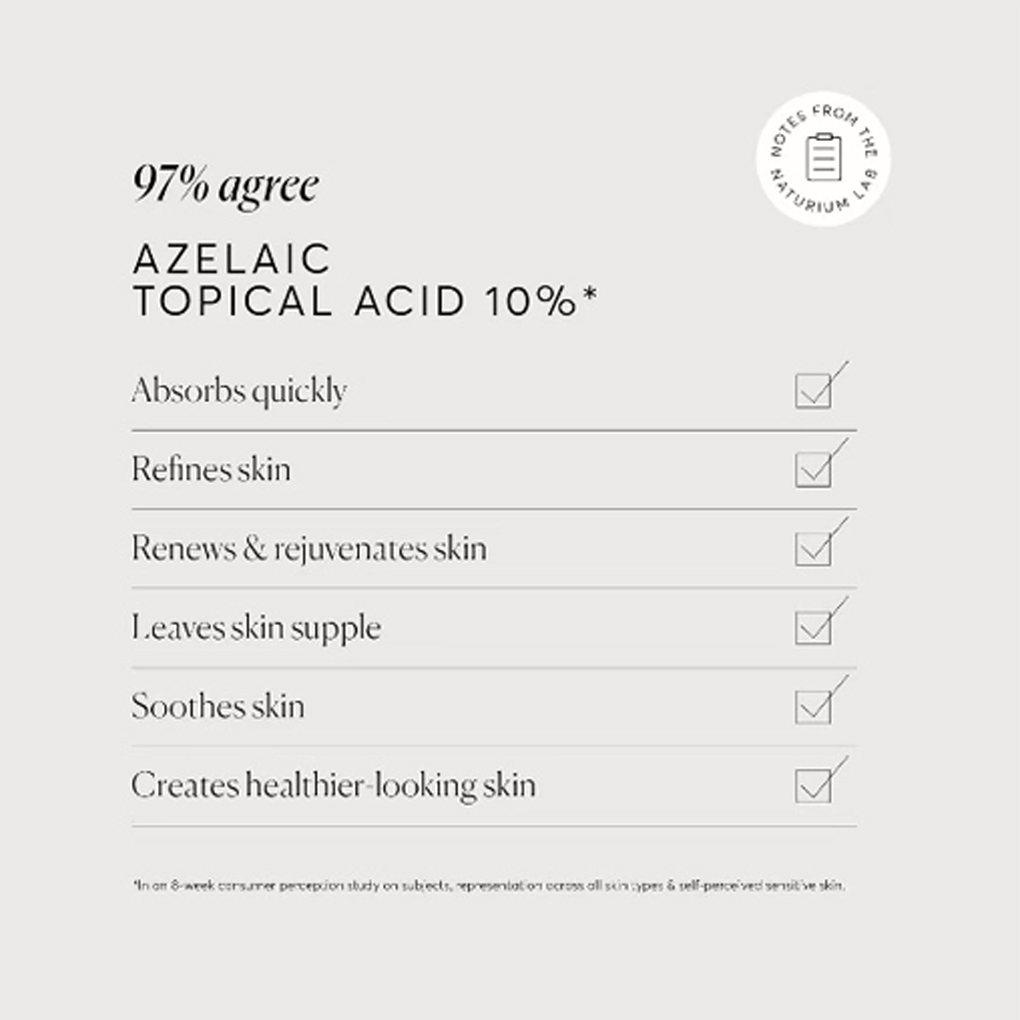

2 Azelaic Acid

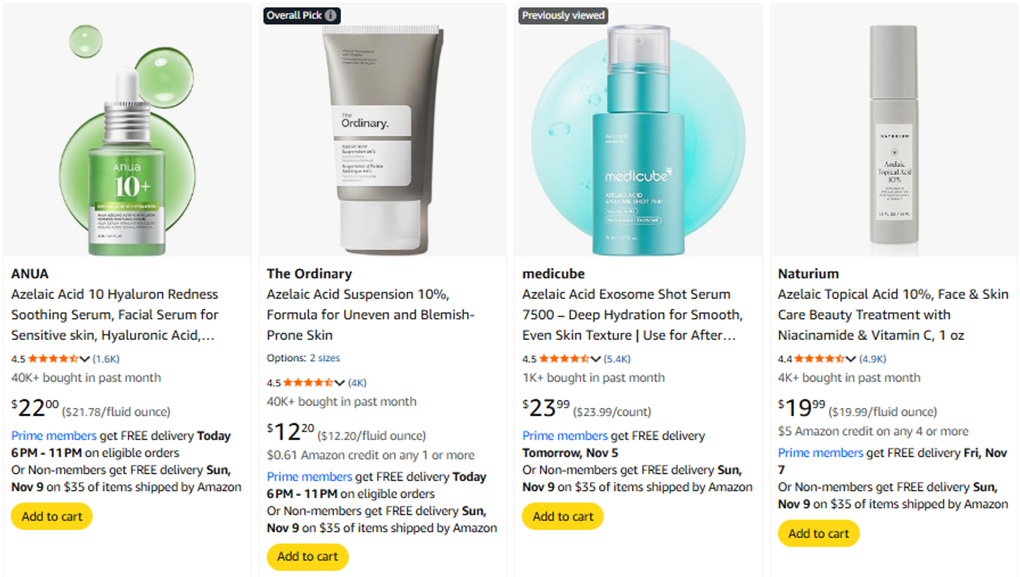

Major azelaic acid products currently sold on Amazon

Known for improving dark spots and acne scars while reducing inflammation, azelaic acid is commonly used in Amazon products targeting acne-prone and sensitive skin. Related keyword searches grew 228%, with both flagship keywords ‘Azelaic Acid For Face’ and ‘Azelaic Acid Serum’ showing growth of over 60%, compared to the same period in 2024. Particularly in a sensitive skin-focused market, consumers tend to prefer products with concentrations appropriate for their skin type to avoid potential side effects from overuse. Accordingly, searches for keywords including specific concentrations—’Azelaic Acid 10%’ and ‘Azelaic Acid 20%’—increased by 108.59% and 61.84%, respectively, compared to the previous quarter.

Leading brands include Paula’s Choice, ANUA, and The Ordinary, with the top five products capturing 87% of clicks. However, branded keywords account for only 35% of related searches, suggesting customers are still in an exploratory phase, searching for the ingredient itself rather than with specific brands in mind. The price range of $12 to $37 positions this market slightly above that of tranexamic acid. That said, lower-priced products in the $12 to $21 range make up 71% of offerings and generate 77% of clicks, indicating that competitive pricing is crucial for lowering entry barriers.

As a market targeting sensitive skin, proven efficacy must be coupled with detailed product information and messaging around gentle formulas. Given that 25% of negative reviews cite unclear product information, it’s clear customers are scrutinizing product detail pages carefully before purchasing. It’s also essential to actively emphasize suitability for sensitive skin with messaging like ‘redness relief’ and ‘low irritation.’ Since this is still a low-awareness market, launching trial kits or smaller sizes to reduce price barriers, or introducing products that combine azelaic acid with more recognizable ingredients like hyaluronic acid3), or niacinamide, would be effective strategies.

3) A signature hydrating ingredient that helps attract and retain moisture, keeping skin hydrated

3 Kojic Acid

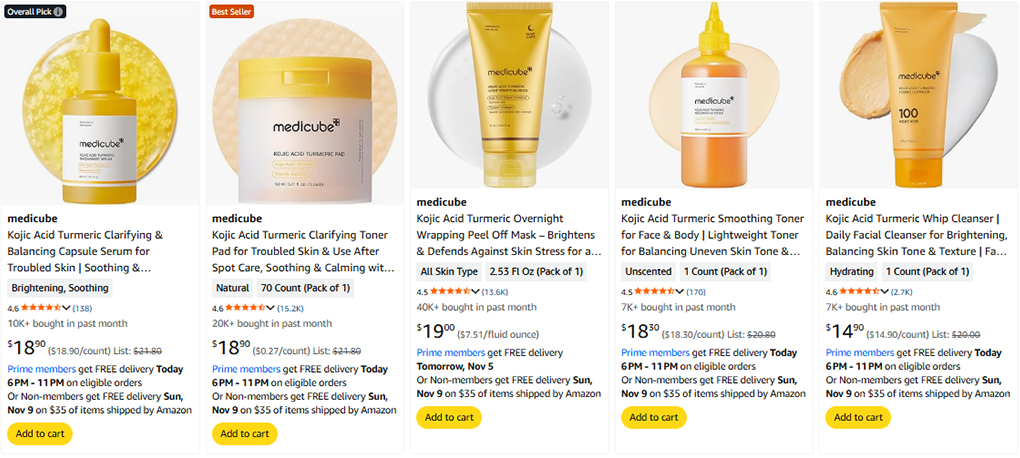

Major kojic acid products currently sold on Amazon

Kojic acid is known for inhibiting melanin production to help address dark spots and blemishes, as well as for its antioxidant properties. While several K-Beauty brands have recently launched products containing this ingredient, it’s not exactly new to Amazon. Built on the foundation of kojic acid soaps with sales histories so long they’ve accumulated nearly 60,000 reviews, the market has been experiencing a resurgence as K-Beauty enters with products across diverse categories. Related keyword searches grew 108%, with searches for the flagship keyword ‘Kojic Acid Serum’ up 142%, compared to the same period in 2024.

Leading brands include VALITIC, with approximately 60,000 reviews, as well as Medicube and SeoulCeuticals. While the top five brands capture 65% of clicks, branded keywords account for only 15% of searches. Customers still appear to be in an exploratory phase, discovering this relatively unfamiliar ingredient through various products. Unlike other ingredient markets where serums dominate, this market—true to its soap origins—features a diverse range of product categories, including cleansers and toner pads.

Many products combine kojic acid with ingredients that offer similar benefits, such as vitamin C and niacinamide, but a distinctive feature here is the prevalence of turmeric. Like kojic acid, turmeric provides antioxidant benefits and skin-soothing properties, making it a strategic pairing for maximizing efficacy and calming effects. Since over 21% of negative reviews mention post-use dryness, formulas that address this concern appear crucial alongside strong efficacy claims. Amazon customers expect K-Beauty to deliver tangible results with minimal irritation, so beyond emphasizing blemish improvement—which existing kojic acid products already do—differentiating through hydration, soothing benefits, and gentle formulas would be a smart strategy.

4 Exosomes

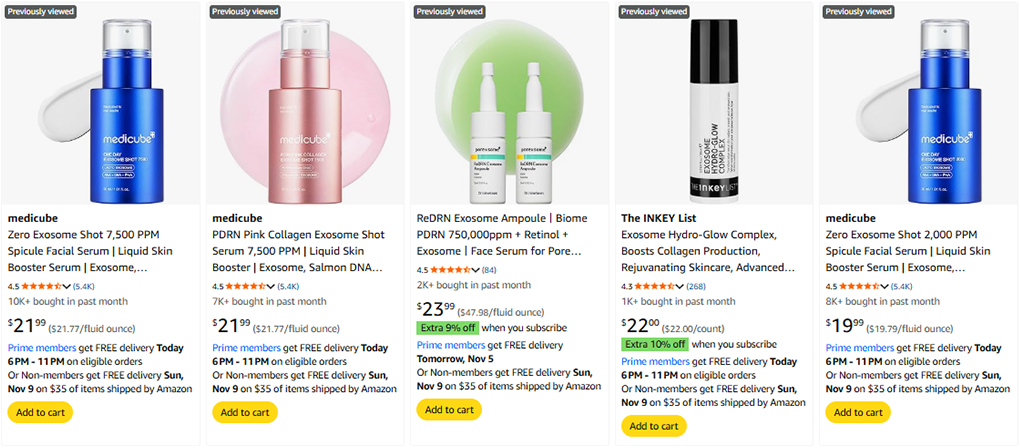

Major exosome products currently sold on Amazon

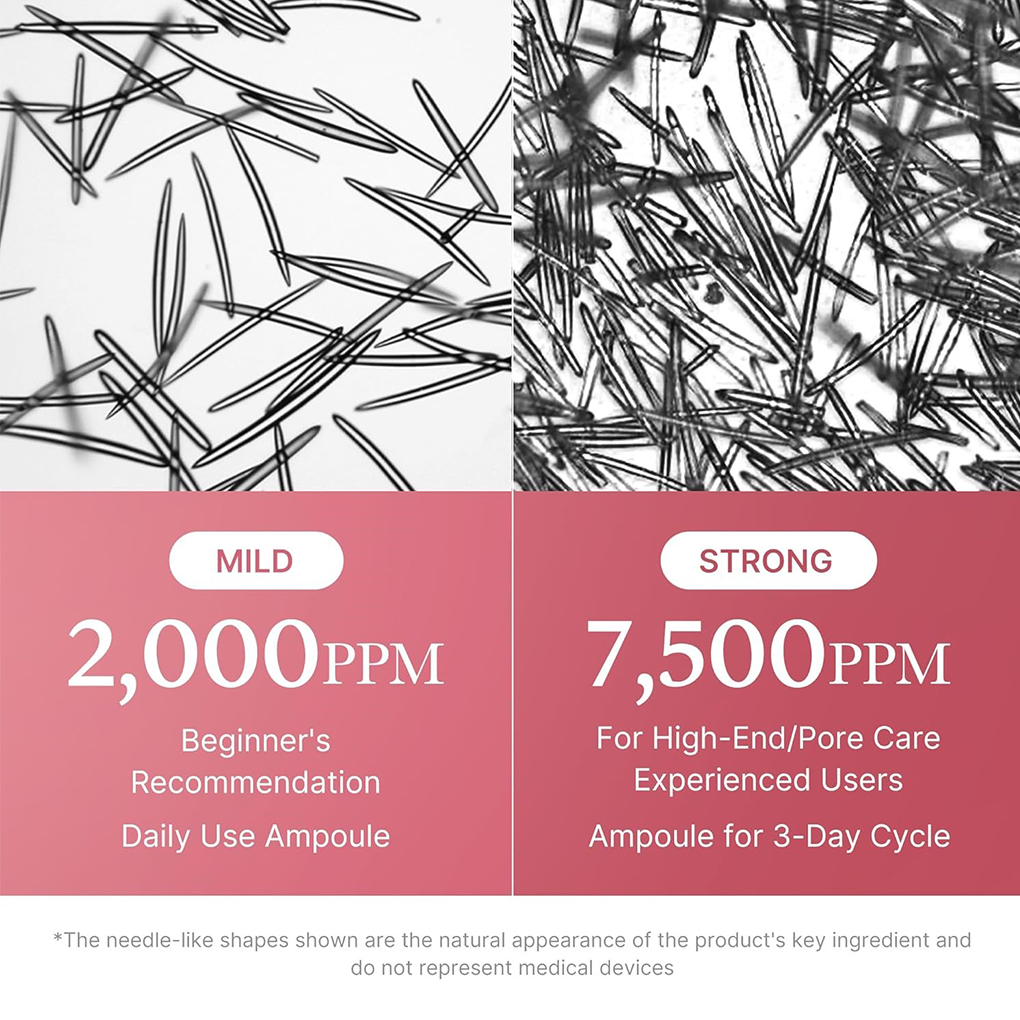

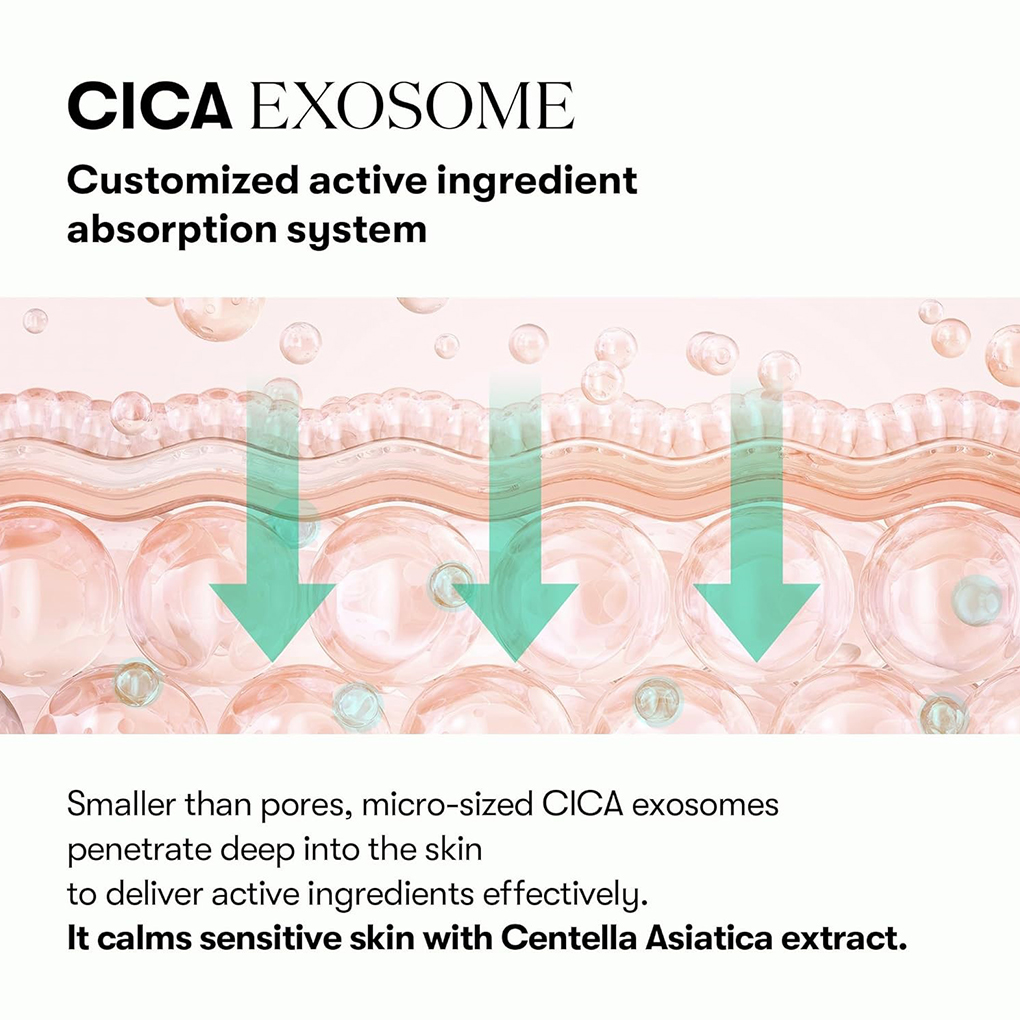

Exosomes are used alongside ingredients like PDRN4), and retinol and are known for supporting intercellular communication to promote skin regeneration. Similar to how ‘Reedle Shot5)’, which delivers active ingredients deep into the skin and stimulates cells, has been gaining attention, exosomes have also been experiencing rapid growth on Amazon recently. Related keyword searches grew 471% compared to 2024, with ‘Exosomes for skin’ and ‘Exosomes Serum’ increasing 21% and 78%, respectively, from the previous quarter.

4) A tissue regeneration activator that helps promote self-repair of damaged cells and tissues

5) A technology using micro-needle-shaped particles that penetrate the skin’s stratum corneum to enhance absorption of active ingredients

Leading brands include Medicube, VT Cosmetics, and GD11, with branded searches accounting for 65% and the top five brands capturing 97% of clicks—this is clearly a market with dominant players. The reason these brands command such a presence isn’t due to a single hero product, but rather their diverse portfolios of exosome-based products. They build varied lineups through ingredient combinations—exosome serums with PDRN, exosome serums with CICA6)—and also diversify by concentration levels like 2,000 PPM7) and 7,500 PPM. Rather than searching with long, detailed keywords that specify brand, ingredient, and PPM, customers tend to search more concisely using brand name + ingredient, and naturally, these keywords dominate search volume. This makes product diversification an effective strategy for presenting multiple options to customers who search for your brand.

Since customers searching for products with potent cell-stimulating efficacy often include terms like ‘Microneedling8)’, or ‘Spicule9)’, product detail pages frequently incorporate these keywords alongside exosomes. Because the core customer base consists of highly engaged consumers expecting professional-treatment-level results, the price range spans widely from $15 to $214, making this a higher-priced market compared to the other ingredient categories. Given the lower price sensitivity, efficacy claims and validation need to be rock-solid.

6) Abbreviation for the English name of Centella Asiatica, known for its skin regeneration properties

7) Parts Per Million, or one part per million; a unit typically used to express trace concentrations

8) A technique using micro-needles to create micro-injuries in the skin to help stimulate collagen production

9) Micro-needle-structured ingredient extracted from sea sponges

#OUTRO

When You Think You’re Late, You’re Really Too Late

Source: Infinite Challenge still cut

With new skincare brands emerging by the day, the ingredient market is evolving so rapidly that yesterday looks different from today. The growing ingredient markets I’ve discussed could easily become saturated, highly competitive spaces in just a few months. That’s why in markets this dynamic, it’s critical to spot opportunities early, launch products faster, invest aggressively to build awareness, and expand your lineup so customer purchases don’t end with a single product. In the increasingly fierce competition among K-Beauty brands, quality and efficacy are table stakes—once you’ve got those basics down, what matters most is speed in responding to customer signals. When you detect customer demand, act on it immediately. If you think you’re late, you really are, and you need to shift your thinking to what’s appropriate for that moment.

If you ask me which ingredients will rise next, I can’t give you a definitive answer. That said, I can share some ways to find clues: Monitor ingredient-focused brands like Paula’s Choice and The Ordinary to identify high-demand ingredients, then position K-Beauty as the alternative. Identify established markets or gaps where K-Beauty is absent—like kojic acid soaps. Recognize that, despite ingredient diversity, demand for powerful efficacy ultimately centers on anti-aging and tone improvement, so focus on ingredients that deliver those benefits. And look at high-demand ingredients in supplements and topical medications—because consumers seeking definitive change often turn to ingestibles and pharmaceuticals first.

Have you ever filtered Amazon search results by release date? By default, Amazon shows you well-established bestsellers, but switching the filter to sort by release date reveals a constant stream of new launches. Even searching daily, I’m amazed by the steady flow of new K-Beauty products—it’s honestly inspiring as a fellow industry professional. Watching various K-Beauty brands not just compete in existing markets but actively pioneer new ones through diverse experimentation makes me proud and inspires me to do even better. The world of skincare ingredients is boundless, and I hope K-Beauty continues to be loved for years to come through an ever-expanding variety of ingredients.

* All data mentioned in the text, including search volume and top brand click share, are provided by Amazon Seller Central (Amazon’s 3P seller platform).

|

Sohyeon Ko |

|

|

Amorepacific

|

|

-

Like

3 -

Recommend

2 -

Thumbs up

2 -

Supporting

2 -

Want follow-up article

2