Columnist Oasis

Editor's note

Oasis is part of Amorepacific’s R&I Center, providing creative inspiration for innovative product development across Amorepacific. In offline spaces, we introduce new trends monthly, while online, we share various insights with members, including trends for Millennials and Gen Z, as well as beauty reports. We started this column because we wanted to connect beyond beauty—sharing what our customers truly love.

#INTRO

There was a time when 'YOLO (You Only Live Once)' defined how Millennials and Gen Z consumed. The message of living in the moment—enjoying life since you only get one—made spending on international travel, luxury goods, and omakase seem aspirational, creating a perception that ‘consumption equals happiness.’ But as the economy slowed and prices rose, a self-deprecating phrase spread: “YOLO today, gone tomorrow.,” and attitudes toward consumption began to shift.

Against this backdrop, a new keyword emerged: “YONO (You Only Need One).” This philosophy—that buying only what you genuinely need is enough—aligns with minimalism and advocates for a life focused on the essentials by cutting unnecessary consumption. Today, let’s talk about low-consumption lifestyle, where spending less actually increases satisfaction.

1 Low-Consumption Lifestyle Becomes Content

Source: Uppity

Have you ever been shocked by your monthly credit card bill and wondered whether someone had used your card without your knowledge? I once panicked at how high my bill was and went through every transaction. As I looked through each item—’Oh, this is where I bought coffee, and this is when I stress-eat snacks…’—I realized it was all me, which was pretty embarrassing. I really didn’t think I’d spent that much.

Looking around, I don’t think I’m alone in this. Maybe that’s why low-consumption content warning against easy spending keeps catching my eye.

1) The ‘I’m Broke’ Influencer

Low-consumption lifestyle is trending on social media. Influencer ‘No Money Yes Vibe (@nomoneyyesvibe_)’ posts daily content about living on 10,000 won during weekdays. She playfully refers to herself as ‘broke’ and turns it into entertaining content. She scores cheap soy milk from the office vending machine and packs homemade lunches with ingredients from her fridge. Her recipes are easy to follow, use simple ingredients, and offer great money-saving tips. Her cheerful narration mixing English and Korean, combined with fun video editing, makes her frugal daily life genuinely enjoyable to watch.

The reason this influencer started creating low-consumption content is apparent: to save money now and provide financial stability for her future self. Low consumption comes across as resourceful, smart, and even a form of self-care.

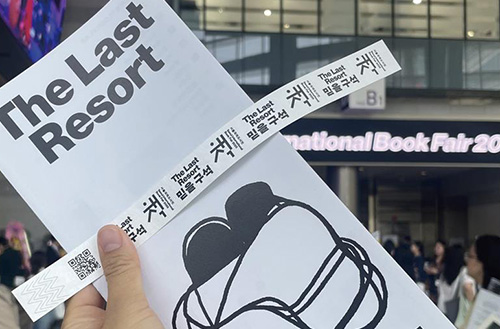

2) Low-Consumption Hits the Bestseller List

Source: News1

The low-consumption trend is evident in bookstores as well. Japanese author Kazenotami’s “Low-Cost Living” hit bestseller status on Amazon Japan and ranked 4th in Kyobo Bookstore’s self-development category (as of October 28). The book introduces ways to protect your happiness without being consumed by spending urges.

What kinds of spending urges tempt us in daily life? For me, when my brain signals that my blood sugar’s dropping, I head to a convenience store. Or whenever I go to Daiso, I feel this urge to buy something—anything—before leaving. That’s the beast called ‘spending urge.’ Another example is feeling like you should buy something just because you got a discount coupon.

The book’s point isn’t ‘spending suppression.’ It’s about ‘finding ways to be happy without spending.’ You organize your money, your basic needs, and your thoughts, then focus on what you truly want and your actual tastes. It's a book that helps you recognize money can't solve everything and shifts your mindset so consumption isn't something you take for granted.

2 Put It Into Practice! Low-Consumption lifestyle

After reading about the bestseller “Low-Cost Living,” I briefly thought I could change my spending habits and live a whole new life. I even considered buying it right away. But then it hit me—buying the book is still consumption. So instead, I looked for low-consumption methods I could try right now that many people already practice.

1) Meal Prep: Good for Your Health and Your Wallet

A new term recently emerged: ‘lunch inflation’ (Lunch + Inflation), referring to rising dining-out costs. As restaurant prices climbed, burgers became the go-to budget meal—you could grab lunch for around 10,000 won. But you can’t live on burgers alone every weekday. That’s why more people started packing lunches. In August this year, lunchbox-related transactions on Zigzag jumped 260% compared to the previous year, and meal prep has emerged as a simple solution for office workers’ meals. Meal prep involves preparing and portioning out 3-5 days’ worth of meals in advance. You can create diverse meals from the same ingredients while reducing food waste. You save money on food while taking care of your health. Search ‘meal prep’ on YouTube and you’ll find tons of content worth trying.

2) Costco Sharing Groups

Source: Uppity

Recently, ‘sharing groups’ have gained popularity—people buy bulk items at Costco and split them up to take home. Costco is famous for selling high-quality ingredients in bulk at low prices. But for single-person households or typical families, the quantities are often too much to consume. That’s where ‘Costco sharing groups’ come in. On Daangn Market (a local community-based marketplace app in Korea), these sharing groups have grown more than 20-fold in the three years since they first formed in 2022. The groups meet in front of Costco, shop together, then divide and distribute items afterward. Actual participants say, ‘It’s great—you can buy quality ingredients at cheap prices, and only as much as you need.’ Low consumption can also be practiced through shared consumption.

3) Using Things Longer Is Low-Consumption

Saving money is low consumption, but using things longer is also a way to practice it. Actor Seungho Yoo shared in a B CAST interview that he’s very interested in environmental issues. He became a hot topic for buying ‘sturdy clothes that protect me’ secondhand and mending them himself when they tear. He says expensive clothes can feel like they own you, but durable garments you can wear for a long time and repair feel comfortable.

The interview went viral on a major portal, with people commenting that the paint-stained, worn clothes he was holding actually looked cool. On TikTok, you can also find videos under #underconsumptioncore that showcase products people have been using for a long time.

#OUTRO

When I’m stressed, I organize my home. In the process, I always discover things that make me think, ‘Why did I buy this? When did I even buy this?’ It was probably impulse purchases driven by stress. But seeing myself get stressed out all over again by those items, I realize that if I’d had my own criteria when buying things, I might not have this stress. Low consumption is ultimately a process of finding ‘a way to consume that’s true to yourself.’ Why not think about what low-consumption practices you could adopt for your own happiness? Wishing you and me both a happy life as I close this piece.

* Sources

- Daangn Market sharing groups - https://news.kbs.co.kr/news/mobile/view/view.do?ncd=8303865

- Zigzag lunchbox transaction increase - https://www.yna.co.kr/amp/view/AKR20250818034400030

|

Oasis (pseudonym) |

|

|

Amorepacific

|

|

-

Like

1 -

Recommend

0 -

Thumbs up

0 -

Supporting

0 -

Want follow-up article

0