-

-

- 메일 공유

-

https://stories.amorepacific.com/en/amorepacific-the-future-of-flagship-stores-final-chapter

The Future of Flagship Stores: Final Chapter

The Path to Success for Offline Flagship Stores in the Sales Competition #5

Columnist

Hee-sun Shin Sulwahsoo Global Commercial 2 Team

Editor’s note

Welcome to the golden age of pop-ups. We analyze the pop-ups that genuinely work. Gone are the days when merely opening a pop-up was enough to spark novelty. What kind of pop-up excites the Millennials, Gen Z, and Gen Alpha? On what basis should the success of a pop-up be defined? What’s the secret behind the popularity of certain pop-ups? A staff member managing our flagship store, Amorepacific Seongsu, analyses the content of today’s pop-ups, flagship stores, and offline retail trends.

#INTRO

Last November, Olive Young created a buzz by opening its first ‘innovative store,’ Olive Young N Seongsu, in Seongsu-dong. The large establishment spans five floors, occupying an entire building of approximately 1,400 pyeong. While it’s Olive Young’s largest store to date, size alone isn’t what earned it the ‘innovative store’ designation. The concept involves ‘offering differentiated customer experiences and novel product curation.’ The store introduced various services and content previously unseen in Olive Young’s traditional sales-focused outlets: from home care lessons to the ‘Skin Fit Studio’ offering skin care services and a ‘Touch-up Bar’ where customers can experience themed makeup looks. When even Olive Young—which has maintained strictly sales-focused stores with the widest selection of brands and products in South Korea among surviving offline cosmetics retailers—opens a content-centered flagship store, it’s clear that brand stores face an increasingly challenging path to success.

(Left) Olive Young N Seongsu operates daily from 10 AM to 10 PM [Source: Olive Young]

(Right) Opened in Seongsu-dong, a hotspot for international visitors; the store remains busy with foreign customers even at 9 PM on Saturday (12/7) [Source: Personal collection]

How, then, should brands operate their flagship stores to ensure success? We faced the same question when opening Amore Seongsu. Unlike pop-up stores, which can quickly generate buzz through their temporary nature, flagship stores operate year-round as permanent establishments. They must consistently attract foot traffic and showcase products attractively to drive sales. The path becomes challenging if we define success through traffic and revenue alone. Products sold offline are already available online at lower prices, and even within the offline retail space alone, we can’t compete with the product diversity offered by retailers like Olive Young.

1 Flagship Stores: Appeal as Space Is the Key to Success

Customers don’t visit flagship stores merely to make purchases. They seek value beyond transactions in these physical spaces. They’re particularly excited by experiences exclusive to flagship stores. The primary draw is the unique atmosphere and ambiance that only physical spaces can create. That’s why successful flagship stores increasingly require distinctive and differentiated spatial aesthetics. The space itself must be ‘somewhere people want to visit.’ However, this means more than just attractive interior design. It’s about creating a unique and differentiated spatial impact while incorporating the brand’s story. The choice of location and its historical context are also crucial factors. When a space naturally showcases its local character or story, it creates an organic sense of distinction. This allows even second and third locations to offer fresh experiences. Though from a different industry, Cafe Onion provides an excellent example. Their third location, Onion Anguk, near Anguk Station, presents an entirely different face from their industrial-style main branch in Seongsu-dong. The Anguk location features unique interiors that preserve and reimagine a hanok, embracing the local character of Bukchon Hanok Village.

(Left) The industrial aesthetic of Onion Seongsu [Source: Blog]

(Right) Onion Anguk. Customers can enjoy coffee while sitting on floor cushions at traditional portable dining tables, gazing at the courtyard as if living in a hanok [Source: Cafe Onion]

Even more impactful was their next opening, Onion Gwangjang Market. Embracing the market’s atmosphere, they created a street-style space of barely three pyeong, complete with plastic stools. Shockingly, their menu is handwritten with markers on the back of cardboard delivery boxes. The content—including the menu—was designed specifically for market customers. Unlike other locations, they reduced coffee portions and significantly lowered prices to match market-goers’ preferences. Beverages come in vacuum-sealed packaging for easy takeout. Given the limited space for leisurely dining, they simplified their bakery offering to a single type of pastry pie, available by the slice or whole, similar to takeout pizza. While maintaining Onion’s signature coffee and menu items, they thoroughly customized the space and enhanced content to match local characteristics. Consequently, each location has become a neighborhood landmark. Each location has transcended being just a café to become a space with its own distinctive character.

(Left) Seoul Jongno-gu’s Gwangjang Market [Source: Cafe Onion]

(Right) Onion Gwangjang Market. Operating hours tailored to market schedule: 11 AM to 2 AM (Break time 7 PM-10 PM) [Source: Personal blog excerpt (Source: JU blog)]

(Left) Onion Gwangjang Market menu board. The menu is written with marker on cardboard boxes to capture the market's atmosphere

(Right) Pastries sold in-store. When purchasing a whole pie, it's packaged like a pizza box for convenient takeout [Source: JU blog]

Flagship stores will evolve away from the traditional offline retail model of replicating identical store formats, instead developing distinct spatial characteristics for each location. Moreover, stores can achieve more significant competitive edge by transforming local and spatial stories into content, ultimately becoming neighborhood landmarks.

2 Products and Content: In Physical Retail, People Buy Emotions

When opening our three flagship stores—Amore Seongsu, Gwanggyo, and Busan—one question sparked intense debate among team members: “What should our pricing strategy be? How should we structure our discounts?” If revenue were our only concern, selling at the lowest price possible would have been the obvious choice. However, given practical constraints, we initially took the bold approach of selling at full price. Eventually, as we moved toward becoming an omnichannel1) store, we decided to match Amore Mall’s discount rate for all products available online. This system continues today.

Through our pricing strategy trials and errors, I made a fascinating discovery: even the mere perception of a discount could effectively drive sales in flagship stores. While customers were excited about making purchases after experiencing the store, full-price purchases often became a psychological barrier. They would hesitate, feeling guilty about not making a rational purchase—particularly in cosmetics, where discounts are common. Interestingly, even a modest 5% discount would ease their minds significantly. Experience taught us that when discount margins weren't substantial, the difference between 10% and 15% had little impact on purchasing decisions. This was because customers were already in a heightened state of purchase desire after experiencing the flagship store.

This illustrates how flagship store purchases are driven by ‘emotion’ rather than logic. Customers come to see, try, experience, and engage with diverse product content. Many even make special trips specifically for these experiences. Therefore, successful flagship stores need new product curation and experiential content that appeals to customers’ emotions.

These experiences derive their exclusivity from being available only offline. I witnessed this firsthand while managing our flagship store, particularly with our beauty classes and customized cosmetics services. These two services at Amore Seongsu have been popular since launch due to our meticulous attention to detail in planning and execution. Our makeup classes, featuring direct coaching from artists, would book up immediately upon opening, often with waiting lists. We became somewhat complacent, assuming the content was universally appealing regardless of the channel. However, when COVID-19 forced us to pivot these beauty classes to online live sessions, the lukewarm customer response was eye-opening. We realized customers valued the in-person interaction—the ‘experience’—more than the actual content.

1) Omnichannel combines the Latin word ‘omni’ (meaning “all”) with ‘channel’ (referring to distribution paths), creating a shopping environment where consumers can experience consistent service across online, offline, and mobile channels, making each channel feel like the same store.

(Left) Examples of various offline classes at Amore Seongsu. Consistently popular [Source: Personal collection]

(Right) Classes and services can be booked through the Amore Seongsu website [Source: Amore Seongsu website]

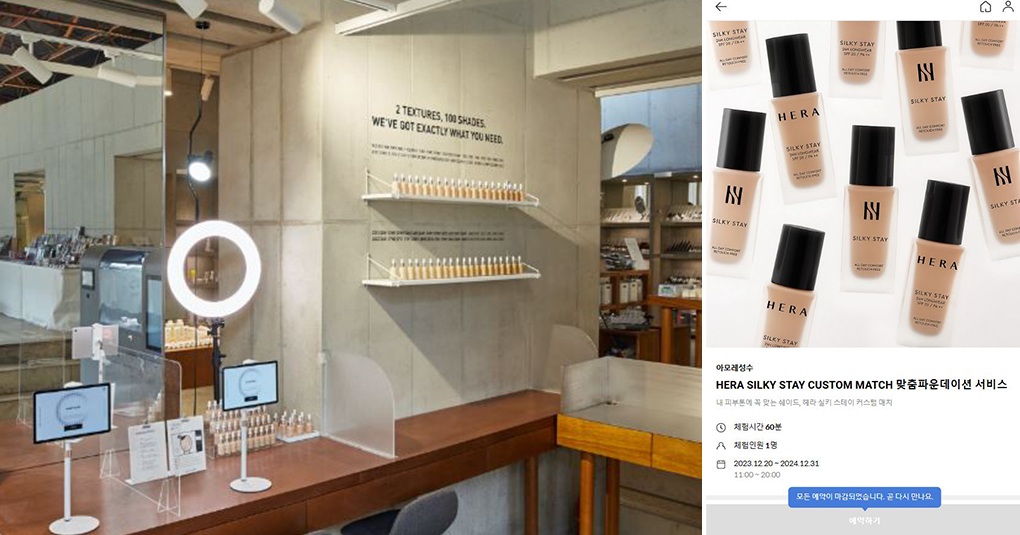

[Left] Amore Seongsu's custom foundation service, BASE PICKER (launched April 2021)

[Right] Now operating as HERA CUSTOM MATCH [Source: Amorepacific Creative, Amore Seongsu website]

This is why exclusive product offerings are essential to flagship store operations. The more appealing the space, the more customers gravitate toward store-exclusive items. One of the most frequent questions staff at Amore Seongsu and Amore Busan receive is, "What products are exclusively available here?" In fact, exclusive products account for up to 10% of Amore Seongsu's total sales revenue. The exclusive product business extends beyond individual items. It offers unlimited potential through store-exclusive set combinations, unique packaging designs, and collaborative promotional merchandise. We can minimize inventory challenges by producing these items in limited quantities while enhancing their appeal. Just as many fashion brands now regularly draw long lines of customers at their flagship stores with limited editions, this has become a common strategy in retail.

(Left) Amore Seongsu’s No. 1 best-selling product: the Amore Seongsu brush [Source: Amorepacific Creative]

(Right) Green Heart merchandise from Amore Busan flagship store [Source: Amore Seongsu Instagram]

3 The Potential of a True Omni Store: NFC, QR, and Google Analytics

If I had to name one regret from managing flagship stores, it would be our inability to fully realize a synergistic omnichannel experience between online and offline platforms. A flagship store’s value shouldn’t be measured solely by offline sales. Our ultimate goal is for customers to have positive brand and product experiences offline that they couldn't get online, leading to purchases through any channel. However, if we had the technology, it would be great to provide shopping convenience for customers visiting our flagship stores and supplement physical displays with online information as a supporting tool.

Space limitations make it impractical to display comprehensive product information through traditional visual merchandising displays. I had hoped customers could access additional product information through smart mirrors or QR codes. Currently, we only have QR codes that link to Amore Mall’s product detail pages. Still, our initial vision was more ambitious: products scanned by customers would automatically be added to their Amore Mall shopping carts. Any discount coupons received during store check-in would apply automatically to these items. This system would increase the likelihood of future purchases even when customers don’t buy on-site immediately after a positive in-store experience. It would also enhance shopping convenience by allowing customers to choose online delivery when purchasing bulky items or large quantities. While Amazon Go's model has online retail leading with unmanned physical stores serving as supplementary channels, I believe a more effective approach for flagship stores is one where the physical store takes the lead role, with online platforms serving to enhance convenience. Furthermore, we could use Google Analytics to analyze the product search-purchase journey of flagship store visitors. This data could also enhance our CRM activities.

With this infrastructure in place, we could take it further by using Google Analytics to track how many store visitors’ product searches convert to actual purchases. This data could also enhance our CRM activities.

#OUTRO

And so we arrive at my final column. Somehow, I spent five years managing flagship stores. While I can’t claim to have found all the answers, I’ve developed an eye for the evolving direction of flagship retail. After beginning this column series, I transitioned to a different team with new responsibilities, making this my final piece on flagship stores and my last involvement. I’m not sure how helpful these insights have been to others. Personally, this has been a meaningful opportunity to reflect on my five-year journey. While there were undoubtedly challenging moments, looking back, it was gratifying. I’ve been exceptionally fortunate with colleagues: working passionately alongside brilliant and impressive teammates has been a joy. I want to take this opportunity to express my gratitude. Thank you.

-

Like

0 -

Recommend

0 -

Thumbs up

0 -

Supporting

0 -

Want follow-up article

0