-

-

- 메일 공유

-

https://stories.amorepacific.com/en/amorepacific-is-there-a-report-that-reveals-a-companys-future

Is there a report that reveals a company’s future?

Engaging and Simplified Tales of ESG #3

Columnist

Myung-kwan Son CSR Team

#INTRO

Today, let’s explore the "Sustainability Report" (SR), which provides insights into a company’s annual ESG performance and outlines its long-term strategic direction.

SR stands for “Sustainability Report,” often abbreviated as "SR" for simplicity. This report, also known as the "Sustainability Report" or "ESG Report," goes by various names. I’ll refer to it as SR for ease of reading in this column. But why do stock market experts pay attention to the SR? Let’s delve into that today.

What is a Sustainability Report (SR)?

A Sustainability Report is a document that introduces a company’s impact and efforts in environmental and social sectors to stakeholders, including customers, investors, and rating agencies. Typically published once a year, around June or July, the report is made available on the company’s website. As a result, May and June tend to be the busiest months for ESG managers. While financial statements disclose a company’s financial status, the SR provides a comprehensive overview, incorporating non-financial metrics.

Source: Apple’s Environmental Report

1 Why Companies Publish SRs

In South Korea, Since Samsung SDI first published an SR in 2004, the practice has grown. By 2024, around 160 of the top 200 companies by market capitalization or approximately 80%, had adopted the practice. But why do companies publish SRs? The reasons vary by era.

[2004-2010] Corporate PR

The early days of SRs were rooted in corporate PR. With no clear standards for report preparation, the content was primarily centered on companies’ social contributions and forward-looking sustainability narratives. Consequently, more than half of these reports were filled with panoramic images of company facilities and impressive visuals. During this period, many corporate newsletters were also integrated into SRs.

[2010-Present] Corporate ESG Scorecard

From 2020 onwards, ESG (Environmental, Social, and Governance) became an indispensable aspect of corporate management, leading to a shift in the purpose of SRs. With the emergence of rating agencies like S&P and the ESG Standards Board that evaluate and rank companies' ESG activities, SRs have taken on greater importance. These agencies heavily rely on SRs for their evaluations, and the results are made public to investors and the general public. Some investment firms have even started incorporating ESG criteria into their investment reviews, further elevating the significance of SRs. However, this shift has also brought challenges. Companies eager for favorable ratings often focus only on meeting the specific criteria set by evaluators, sometimes omitting unfavorable information with little regulatory recourse. Additionally, various rating agencies' differing standards and data requirements create confusion and redundant work for ESG managers.

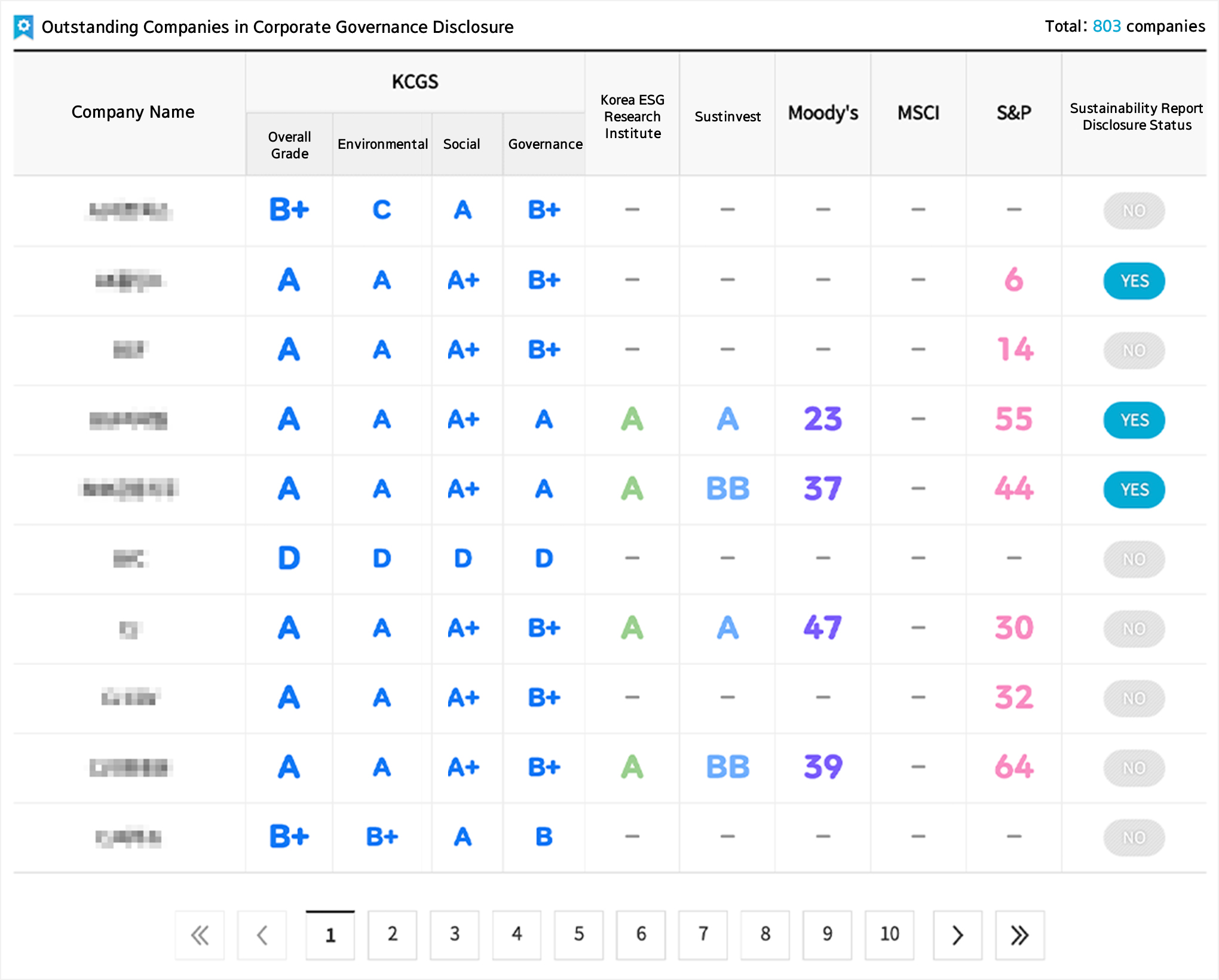

The Korea Exchange ESG Portal provides a comprehensive view of each company’s ESG evaluation results.

/ Source: Korea Exchange ESG Portal

[Post-2025 Future] The Mandatory Disclosure of ESG

Due to the limitations mentioned earlier, there is an ongoing discussion about making ESG disclosures mandatory, standardized, and linked to financial reporting, much like business reports or financial statements (this is currently one of the hottest topics among ESG professionals).

The critical issue here is ‘mandatory disclosure.’ Previously, companies engaged in ‘voluntary disclosure’ according to specific standards, but now, they must comply with the criteria and timelines set by the Sustainability Standards Board within the Accounting Standards Board, and any omissions or errors in the reports may be subject to penalties. Moreover, it's anticipated that these reports, once dominated by images and graphics, will increasingly focus on technical expressions centered around data. In essence, the role of SRs is shifting from PR (public relations) to IR (investor relations).

With this shift to mandatory disclosure, we can expect to gain insights into each company's opportunities and risks in pursuing sustainable business, as well as their key medium—and long-term strategies. Therefore, if you're interested in the stock market or have investments in particular companies, it’s now more important than ever to thoroughly review their SRs.

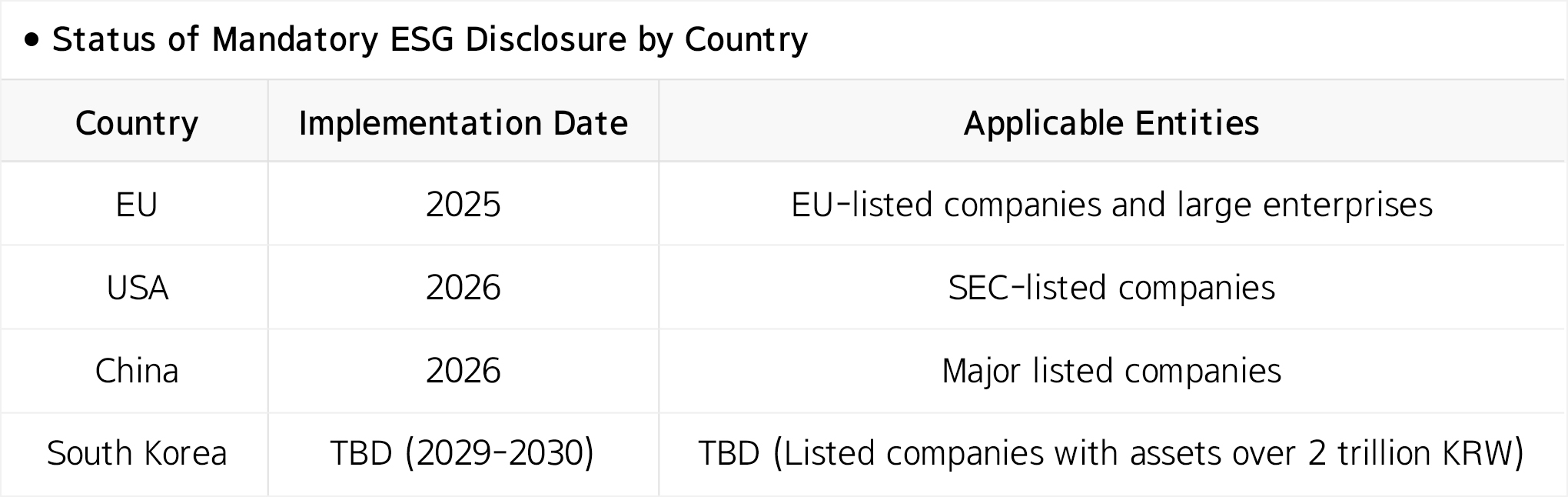

So, when will this mandatory disclosure take effect? It’s expected to happen in South Korea as early as 2029 or, at the latest, by 2030. All listed companies with assets exceeding 2 trillion KRW must submit an SR. Of course, the global trend is moving faster. In some places like the United States or Europe, mandatory disclosure will begin as early as 2025, so companies engaged in international business must accelerate their preparation for mandatory SR compliance.

2 What Does an SR Include?

While the format and structure of SRs may vary slightly from company to company, most include the following five elements:

1) Company Overview

This section provides basic information about the company, including its history, business structure, subsidiary brands, domestic and international sales, number of employees, and value system.

2) Materiality Assessment

Materiality assessment analyzes the most critical factors or issues for a company to maintain a sustainable business. Knowing these key factors is essential for effective response. Through materiality assessments, companies typically identify three to ten essential items. For example, Amorepacific focuses on ‘packaging environmental impact’ and ‘climate change response and energy management,’ while manufacturing-focused companies like Samsung Electronics may emphasize ‘supply chain’ or ‘energy supply and demand.’ These items may change according to societal and environmental shifts, leading to adjustments in sustainability strategies.

3) Sustainability Goals and Strategies

Once the critical factors for sustainability have been identified through the materiality assessment, the report proceeds to explain the company’s management strategy, governance, system, goals, and implementation strategies to address and bridge these gaps. Careful reading of this section can provide hints about where the company will invest in the future, what risks they consider essential, and their focus areas.

4) Key Performance

This section outlines the essential ESG (Environmental, Social, Governance) performance indicators for the year, which align with the set goals. There are several globally recognized reporting frameworks, and as ESG disclosure becomes mandatory, reports are expected to be standardized under a single format.

5) Additional Attachments

This section includes additional tables and data not covered in the main sections. Examples include financial statements, income statements, greenhouse gas emission data, waste generation data, water resource usage, number of employees, social contributions, the reporting framework used, and verification statements.

3 Why Is the SR Important?

The SR is an integrated document that provides insight into a company's non-financial status. It is filled with information that financial statements alone cannot capture. The SR includes forecasts and response plans influenced by internal and external factors, enabling investors to assess a company's sustainability and future value.

It is also invaluable for individual investors like us. SRs are easily accessible on company websites; most are written narratively, complemented by photographs, diagrams, and images. This makes understanding detailed and accurate information about companies of interest easier. For those curious about corporate SRs, the Korea Exchange ESG Portal is an excellent place to start exploring.

In truth, delving deeply into SRs could fill an entire book. Today, however, let's take satisfaction in having broadened our understanding of SRs, and I'll conclude this column with a candid interview with our company's SR specialist.

An Interview with Amorepacific’s SR Specialist: Sang-seok Nam, Sustainability Management Center

What is the purpose of Amorepacific Group’s Sustainability Report?

In a nutshell, it is to communicate Amorepacific Group’s key sustainability management activities and achievements to internal and external stakeholders. The SR serves as a report that discloses the company's sustainability efforts and results, crafted by the reporting principles of major global guidelines (GRI, SASB, TCFD, ISSB, etc.). As the demand for ESG disclosure and evaluation intensifies, along with stricter disclosure obligations and regulations, the usefulness of sustainability reports continues to increase.

What makes a well-written SR stand out?

First, a clear and visible table of contents and structure. Second, a report that covers all topics based on the sustainability framework (governance/strategy/risk management/metrics and targets). Third, clarity in the company’s goals, medium—and long-term strategies, and performance. While some reports only list the achievements of the current year, a good report includes short-, medium--, and long-term goals and strategies.

What is the most challenging aspect of preparing an SR?

The most challenging part is the English translation. Many global investors consider ESG a crucial investment criterion, and it’s essential to clearly communicate our ESG efforts and achievements to a diverse range of international stakeholders (customers, partners, suppliers, etc.) through accurate translations. Sustainability reports contain numerous technical terms related to environmental, social, and governance issues, and to meet the standards required by global guidelines and ESG rating agencies, translation needs to be professional and standardized, not just a simple conversion of words. Although we have translation agencies, we cannot rely entirely on them. As mentioned, relying on general translation agencies can lead to mistranslations or overly literal translations, so internal review is essential. (For the 2023 SR, we didn’t use a translation agency; instead, we utilized AP ChatGPT for in-house translation! Haha.)

Where would you focus first if you had only one minute to review an SR?

The "Materiality Assessment" section. Materiality assessment is the process of identifying and prioritizing ESG issues that significantly impact the company’s business value chain and its internal and external stakeholders. This allows you to quickly grasp not only the company’s key issues but also related governance, strategies, objectives, and performance.

-

Like

0 -

Recommend

0 -

Thumbs up

0 -

Supporting

0 -

Want follow-up article

0