Carbon equals ‘Money’

Engaging and Simplified Tales of ESG #2

Columnist

Son Myung-kwan CSR Team

#INTRO

Recently, Korean researchers achieved a remarkable feat of creating diamonds from carbon under atmospheric conditions. It feels like modern-day alchemy in the 21st century. While we’ve all heard of Bongyi Kim Seon-dal, who supposedly sold water from the Daedong River, the idea of producing diamonds from airborne carbon sounds equally fantastical. The leaps in technology are truly astounding.

Diamond crystals created using the RSR-S device., Source: Maeil Business Newpaper

What’s even more incredible is the claim that, in the near future, ‘carbon equals money.’ This equation applies not only to businesses but also to nations and individuals. But why is this? The answer lies in achieving ‘carbon neutrality’ to combat the climate crisis. Carbon (C) is ubiquitous, found in trees, coal, and even our bodies. When carbon becomes a gas and combines with oxygen, it forms carbon dioxide (CO2), a primary culprit in global warming. Thus, minimizing the release of carbon into the atmosphere has become crucial, requiring significant expense and effort. Today, we explore global carbon trends in the context of financial implications.

1 Carbon = Money [National Perspective]

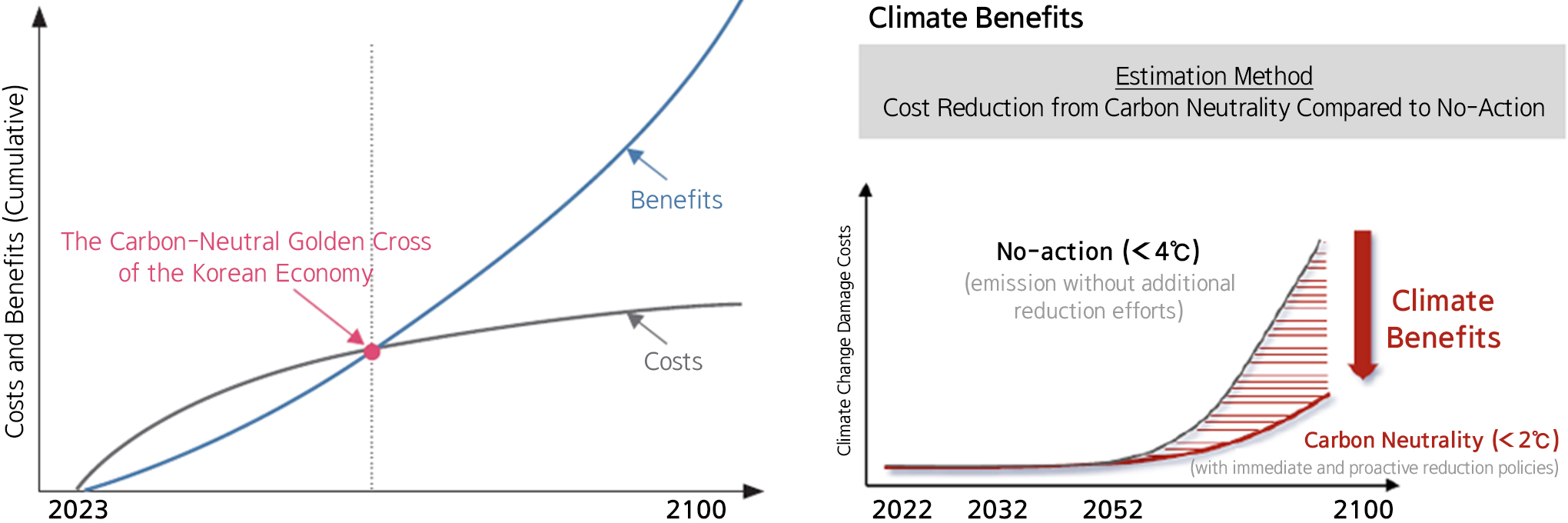

1) South Korea's Climate Benefits Valued at 3,090 Trillion Won

In 2023, the Korea Chamber of Commerce and Industry introduced the term ‘climate benefit’ in their ‘Carbon Neutrality Strategy Report.’ This concept suggests that the benefits of investments to mitigate global warming outweigh the associated costs. By 2100, South Korea is expected to invest around 1,850 trillion won in climate stabilization measures, such as transitioning to renewable energy and investing in low-carbon technologies and infrastructure. Although this entails immediate financial loss, the report predicts a resulting economic benefit of 3,090 trillion won by preventing high temperatures, floods, and sea level rise. Essentially, carbon neutrality not only contributes to public welfare and environmental preservation but also translates into tangible ‘economic gains.’

Source: Korea Chamber of Commerce and Industry (Carbon Neutrality Strategy Report for a New Leap of the Korean Economy, 2023)

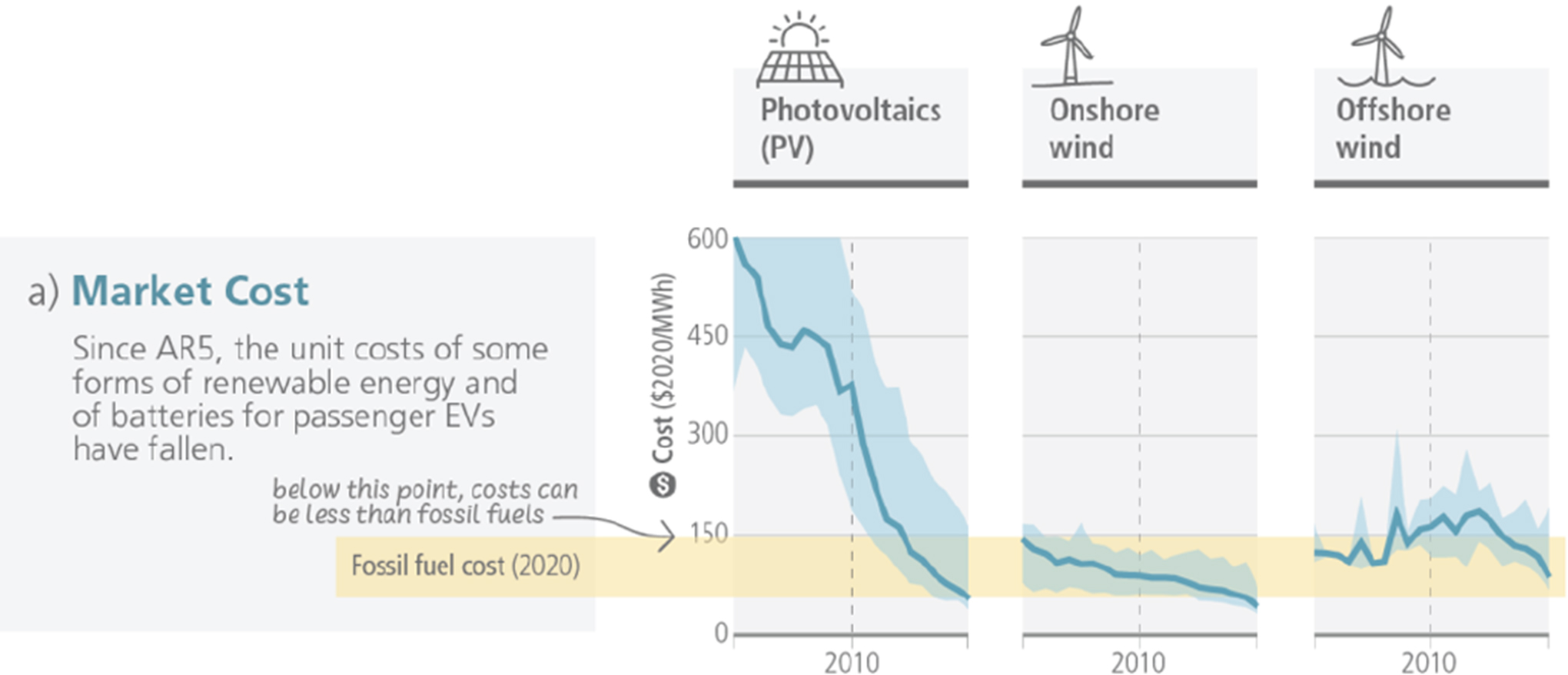

Solar Power is Cheaper than Coal!

One historical drawback of renewable energy has been the high initial investment costs. However, remarkably, around 2020, the cost of renewable energy production in some countries became cheaper than coal-fired power. What drove this change? Technological advancements, improved processes, and economies of scale prompted by greenhouse gas reduction targets. Following the 2016 Paris Climate Agreement, countries committed to reducing greenhouse gas emissions by 40-50% from previous levels. Despite industrial growth, achieving these ambitious targets meant overhauling the energy sector, which is the largest source of carbon emissions. Consequently, nations have been installing vast numbers of solar panels and wind turbines. According to the International Energy Agency (IEA)*, renewable energy generation is expected to surpass coal-fired power by 2025. By 2024, renewable energy is projected to account for over one-third of the world's total power generation.

Source: IPCC AR6 SYR Report

The turning point (grid parity), when the cost of renewable energy installations becomes cheaper than fossil fuels, is approaching soon.

From a national perspective, China's growth stands out. As the leading carbon emitter, China is aggressively pursuing energy transition. It has massively expanded its solar manufacturing infrastructure and streamlined processes to cut costs drastically. As a result, China has become possible to produce solar installations at relatively low prices, and in 2023, its solar installation capacity matched the global total from 2022. In the coming decades, the energy dominance might shift from oil-rich Middle Eastern countries to others. Countries abundant in wind (for wind power), sunlight (for solar power), or large rivers (for hydropower) might become the new energy powerhouses.

A solar power plant in Datong, Shanxi Province, China, Source: BBC

It is shaped like a panda, Source: Google Maps

2 Carbon = Money [Corporate Perspective]

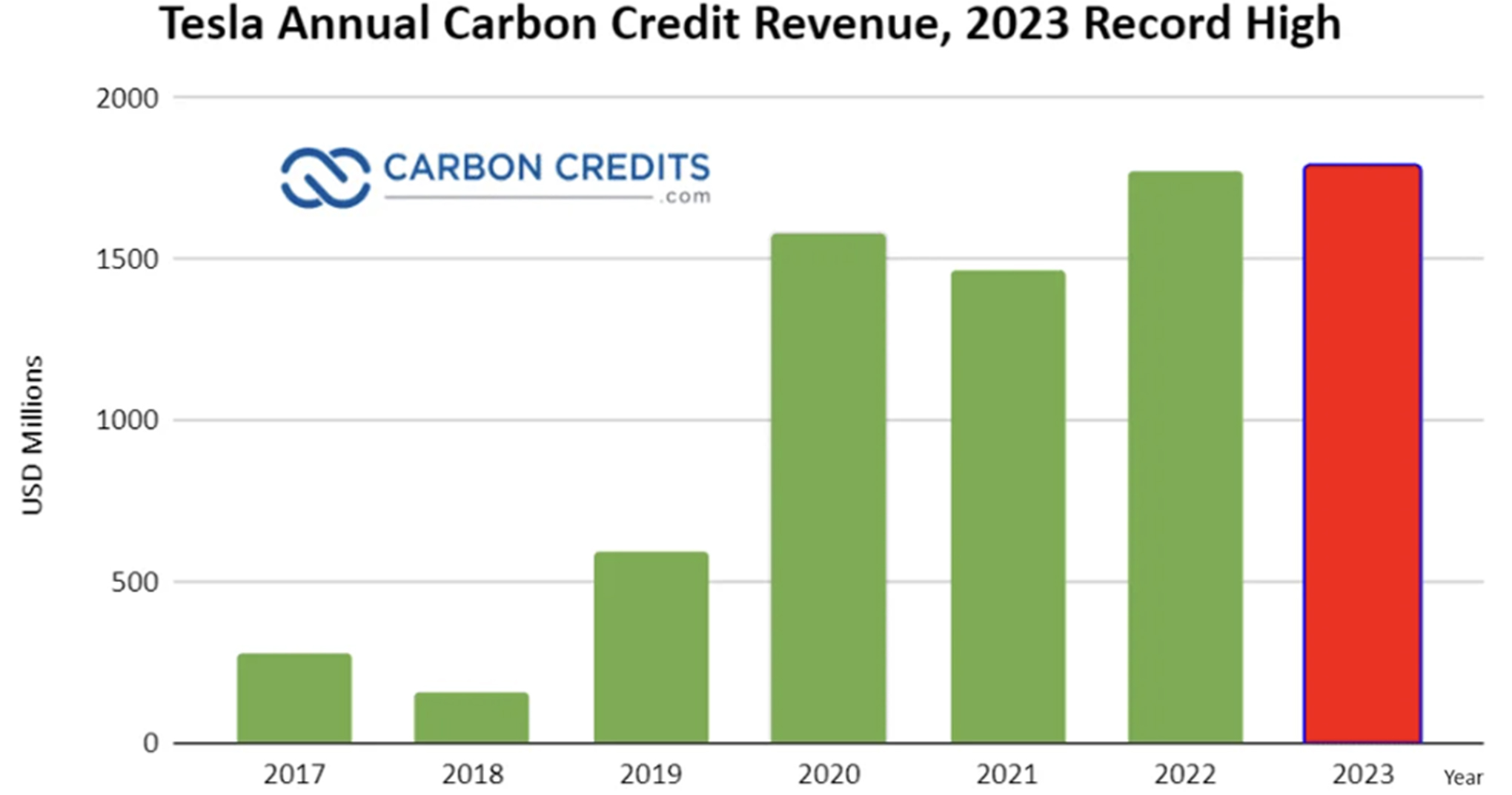

1) Selling ‘Carbon Emission Permits’

Just as we buy garbage bags to dispose of trash, in some countries, companies must pay if they exceed a certain amount of carbon dioxide emissions. Conversely, they can sell their surplus to other companies if they use less carbon or do not emit it. This is known as the "carbon emission permit" system. One company that has greatly benefited from this system is Tesla. As an electric vehicle manufacturer, Tesla secured significant carbon emission permits. It then sold these permits to companies in the EU and China that produce internal combustion vehicles. In 2023, Tesla earned a staggering 2 trillion won from such sales, a substantial portion of its approximately 11 trillion won operating profit for that year.

2) The Rise of 'Carbon Hunters'

Speaking of Tesla, let's talk about its founder. In 2021, Elon Musk launched a competition offering $100 million (130 billion won) to startups with carbon removal technologies. The grand prize, announced on Earth Day 2025, is about 66 billion won. This initiative aims to support innovative companies that reduce carbon emissions and capture, remove, and absorb greenhouse gases already present in the atmosphere. The carbon capture market appears promising for future value. Here are two leading global carbon capture companies (carbon hunters).

[climeworks]

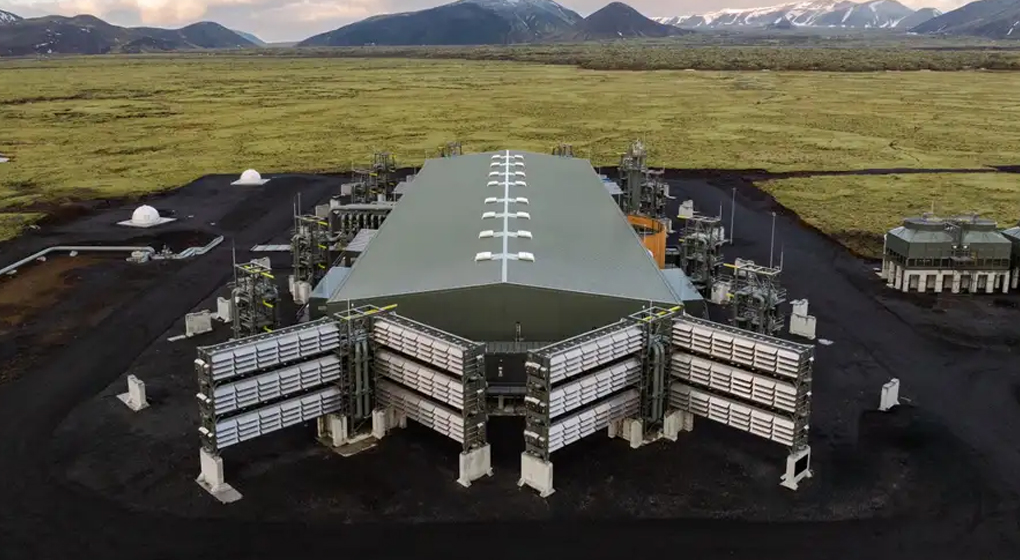

‘Climeworks’ operates extensive facilities in Iceland that use filters with carbon-absorbing properties to capture CO2. The captured CO2 is then supplied to greenhouses where vegetables grow, and the massive energy required for the facility is provided by geothermal power. Additionally, Climeworks can sell the credits obtained from capturing carbon to private companies. However, the facility's operation consumes significant water and energy, indicating a need for further improvement in economic and efficiency aspects.

Climeworks carbon capture facility, Source: climeworks website

It resembles a gigantic air purifier, Source: newscientist.com

[Lithos Carbon]

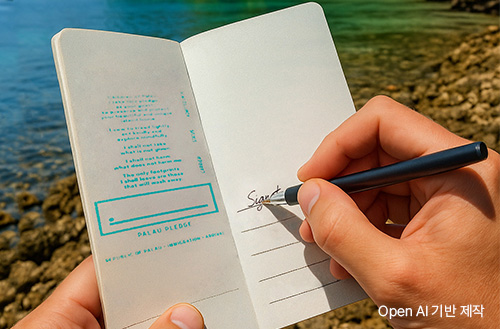

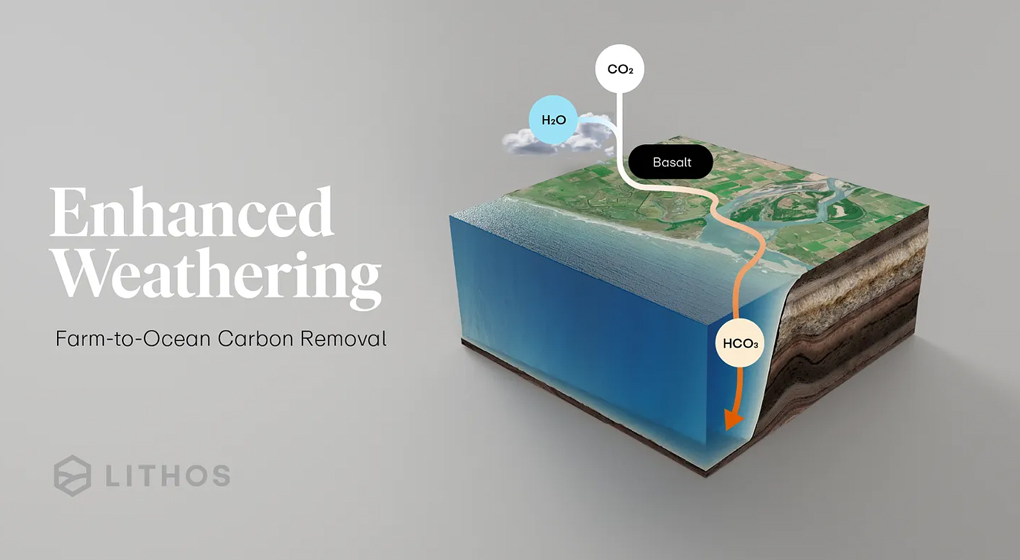

When basalt weathers into powder on the surface and comes into contact with rainwater, it triggers a chemical reaction that traps carbon dioxide from the rainwater. Basalt powder also contains nutrients (calcium, magnesium, etc.) essential for soil restoration. Lithos Carbon is developing fertilizers using these properties of basalt powder. They are focused on techniques to apply basalt powder based on soil conditions and crops. If successful, it could enhance crop yields and soil resilience while absorbing carbon.

Spreading basalt powder on farms

The basalt stone walls in Jeju Island, once passed by without a second thought, now look like money.

Source: Lithos Carbon

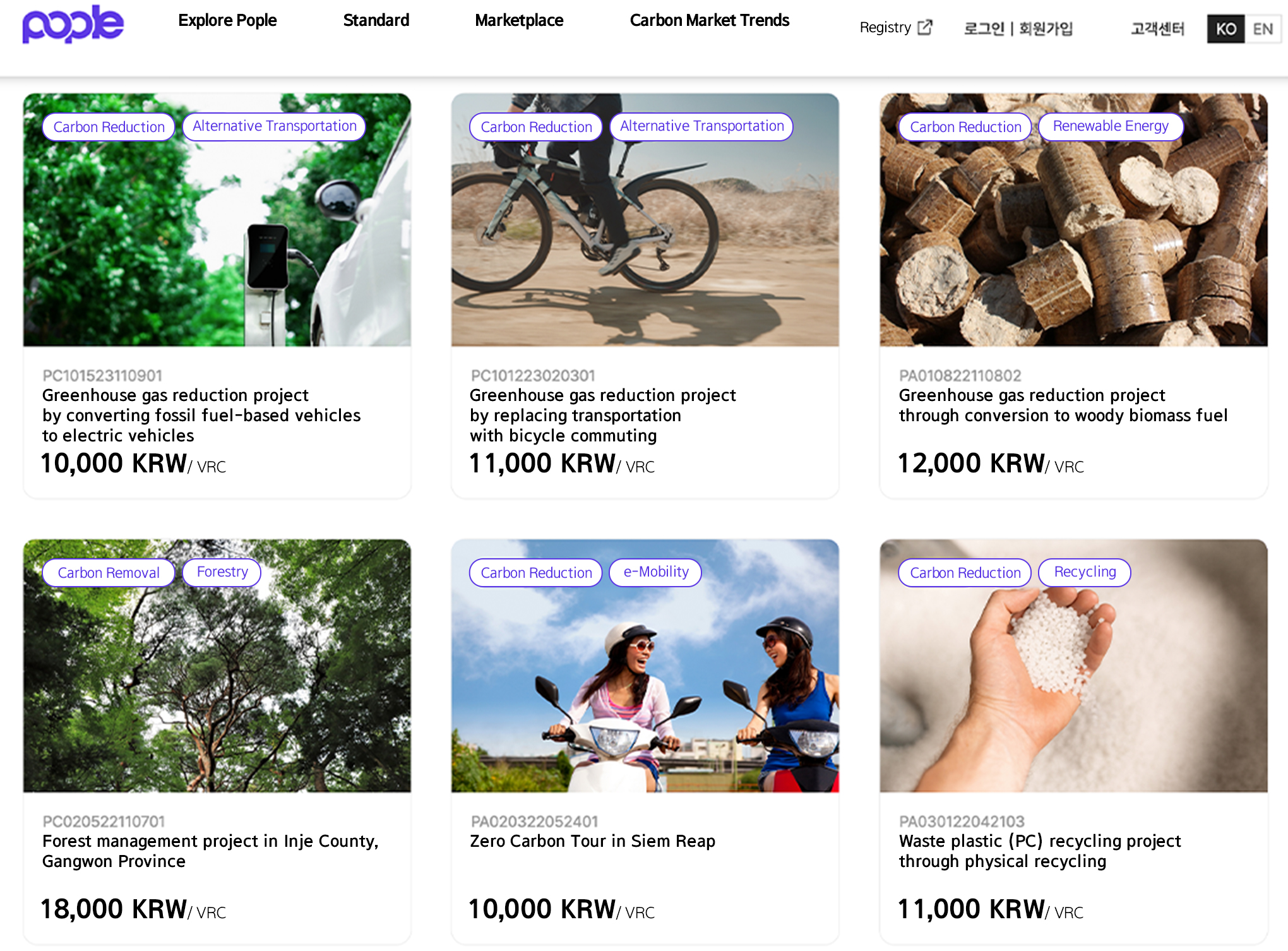

3) Who Wants a Ton of Carbon?

As more countries adopt carbon emission permit systems and companies emerge to capture carbon, platforms for trading carbon-like stocks are also developing. Carbon capture companies can convert carbon into credits and sell them in the market, while companies committed to carbon neutrality can purchase the necessary carbon credits. Though the carbon market has not been fully established, we may soon see professional carbon traders.

Source: POPLE website

Carbon trades for about 10,000 to 20,000 won per ton.

4) What About Amorepacific?

As awareness of climate change grows, consumers are increasingly drawn to brands that prioritize sustainability. Naturally, this means they are more likely to choose products from companies that produce fewer carbon emissions. Amorepacific is making significant strides in this regard. In 2023, Amorepacific reduced greenhouse gas emissions by approximately 40% compared to its baseline year 2020. This achievement was made possible by expanding solar panel installations to increase self-generated energy and through power purchase agreements (PPA) with renewable energy providers. Amorepacific is trying to achieve its 2025 goal of RE100 (100% renewable energy use).

Moreover, the "A MORE Beautiful Challenge," now in its third year, continues to thrive. This initiative identifies and supports social ventures in the ESG (Environmental, Social, Governance) sector, facilitating collaboration and investment with Amorepacific. In 2024, a new "Net Zero" category will be added to support social ventures with innovative solutions for △carbon offsetting, △credit development, issuance, and management domestically and internationally.

3 Carbon = Money [Individual Perspective]

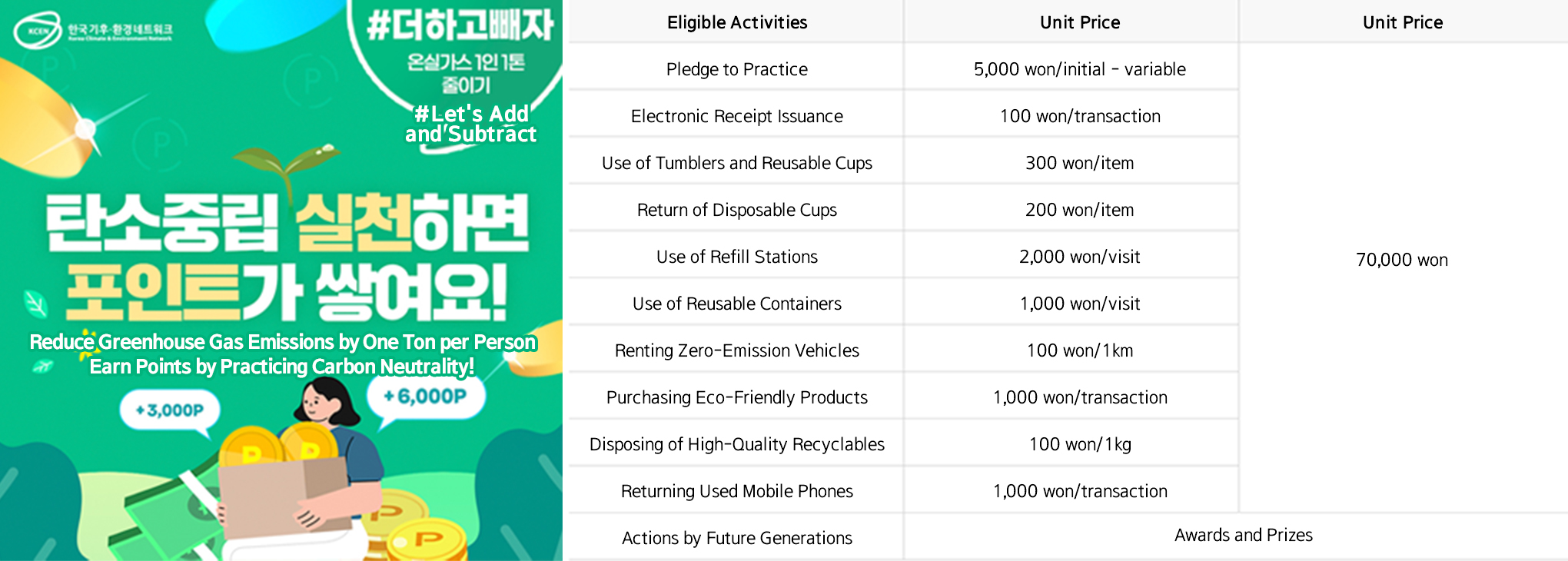

1) Earn Points by Reducing Carbon

There is a system that rewards individuals with cash-like points for engaging in everyday carbon-neutral activities, such as using tumblers and receiving electronic receipts. This system, run by the Ministry of Environment, is called the ‘Carbon Neutral Point System.’ Since its inception in 2022, it has attracted 1.04 million participants. Depending on the activity, individuals can earn between 100 and 2,000 won in points annually, with a maximum of 70,000 won. There are even discussions about improving personal credit scores for sustained participation in carbon-neutral activities.

Source: https://cpoint.or.kr/netzero/

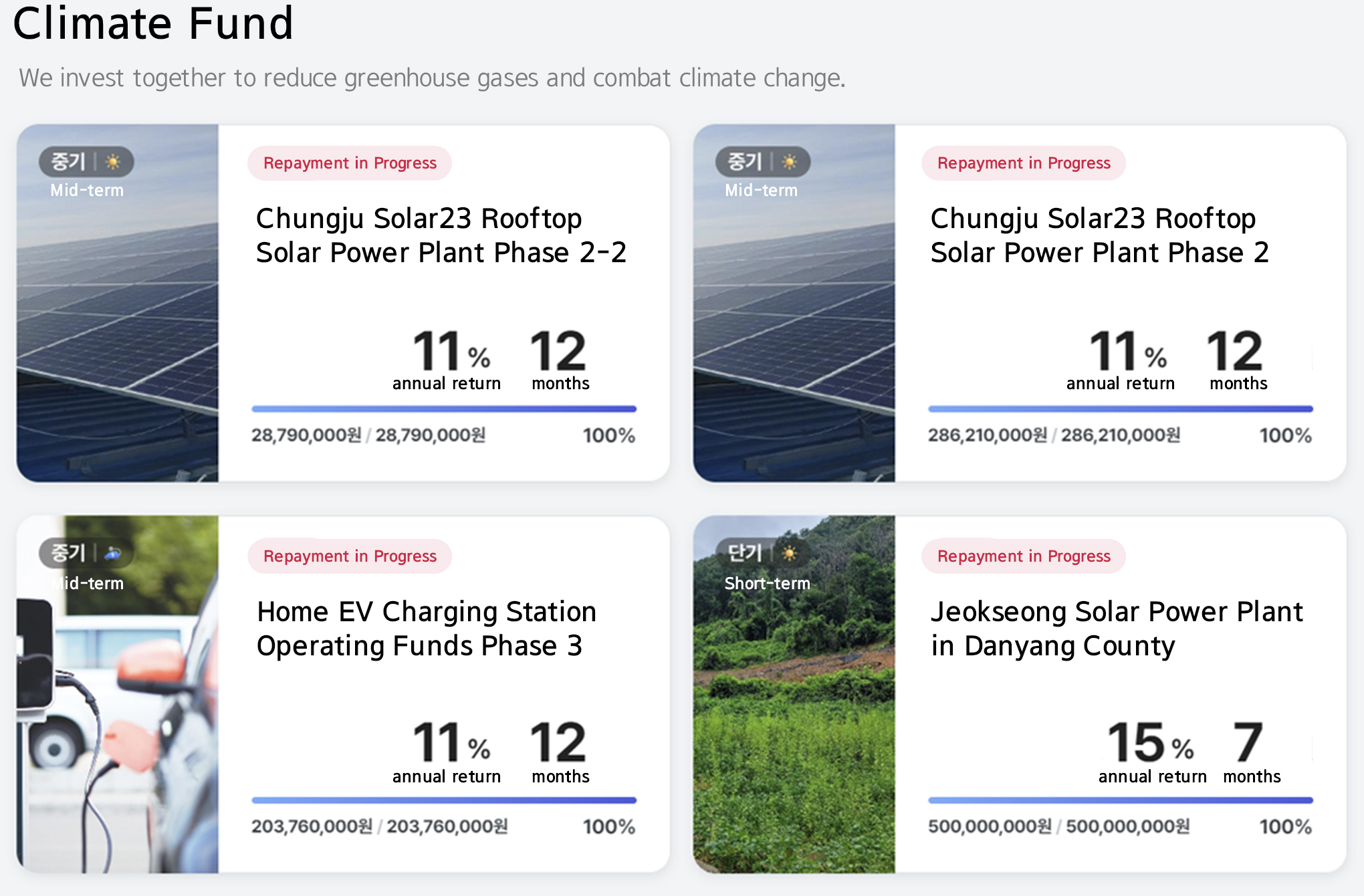

2) Looking for Investors for a Solar Panel 'Block'

Have you heard of the ‘Renewable Energy Investment Platform’? This fintech service connects private renewable energy developers, landowners, and individual investors. Typically, investing in renewable energy infrastructure requires substantial capital, but this platform allows individuals to contribute smaller amounts and indirectly support carbon reduction.

Source: Root Energy website

Investments in these products carry the risk of principal loss. Please review the terms and conditions carefully before investing.

#OUTRO

Today, we explored new markets and companies related to carbon. Do you now find some truth in the equation ‘carbon equals money’? As climate change worsens, the once-invisible carbon becomes as tangible as actual currency. Of course, we can't put a price on our planet and environment. However, for nations and corporations, economic logic often takes precedence over noble ideals. This logic is becoming increasingly apparent. Now is the time to act.

"It is the cheapest today."

This isn’t about real estate prices in Seoul. It’s about the economic value of the environment we use. The environment was previously seen as a free resource, but its cost is rising as the climate crisis approaches. If we don’t act quickly, these costs will compound and strike us, potentially leading to a kind of ecological bankruptcy. Hence, our awareness and actions are more crucial than ever.

In our next column, we will explore how to create and purchase sustainable cosmetics. Stay tuned!

-

Like

0 -

Recommend

0 -

Thumbs up

0 -

Supporting

0 -

Want follow-up article

0