People Investing in Water

About the Value of the Water Resources Industry #1

Columnist

Ha Sun-jin Sustainability Management Center

#INTRO

Greetings, I’m Ha Sun-jin from the Sustainability Management Center, and this year, I’ve been tasked with penning a column on “water.” Although it’s already March, it still feels like the beginning of the year, so before diving into our discussion on precious water resources, I’d like to broach a subject many people include in their New Year’s resolutions: “investment.”

You may remember the 2016 release “The Big Short,” a film based on the true story of Michael J. Burry, who predicted the global financial crisis between 2007 and 2008 and made a fortune by betting on it. At the movie’s end, there’s a scene where the protagonist steps away from the financial market, standing in front of his drum set in his office, gazing into the distance. A subtitle reveals that he has chosen “water” as his sole investment target. This contrasts with the earlier-depicted, tumultuous financial market scenes, highlighting Burry’s insight into the importance and sustainability of water, an essential yet finite resource in our lives.

The actor Christian Bale portrayed Michael Burry in “The Big Short.”

Source: The Telegraph

The fact that the protagonist, a savvy investor with an uncanny intuition, chose water naturally spark a sense of emulation among novice investors. Water, an indispensable element of our lives, also plays a significant role in investments. In the United States, where securities investment has become a standard method for retirement planning, there are various ways to invest in water.

“Investing in water” means putting money into companies engaged in water-related business activities. The reputable investment institution S&P has designed the S&P Global Water Index, which tracks up to 50 listed companies involved in water utilities and materials. This includes indispensable industries such as wastewater treatment services, water pump companies, and manufacturers of pipes and flow meters. When comparing the performance of the water-related industries with the S&P 500, which represents the market capitalizations of the top 80% of the total U.S. stock market, the investment value of the water sector is evidently competitive with that of major U.S. stocks.

Long-term Trends of the S&P Global Water Index

Source: S&P Global

1 Invesco Water Resources ETF (PHO)

Even individuals living in Korea can effortlessly invest in the steadily growing water-related industries of the United States. A predominant method is investing in an ETF that bundles the value and growth stocks of companies providing water to households and businesses and possessing technologies to save or recycle water. A notable ETF in the water industry sector is PHO (Invesco Water Resources ETF), which humorously shares its spelling with Vietnamese pho. PHO includes companies such as American Water Works, a public utility company providing water services in the U.S., and Waters Corporation, a firm specializing in water-quality analysis equipment. Households and businesses cannot survive a day without tap water, and, especially in a vast continent like North America, companies that supply water to towns everywhere are essentially immortal. This ETF has been designed to offer easy access for investors interested in water but who find individual company analysis and prediction challenging.

PHO (Invesco Water Resources) ETF Chart

Source: Google Finance

Of course, investing in individual stocks is also an option. Some investors may not favor ETFs, which bundle various quality companies like a department store, due to the risk associated with some growth stocks or the low growth of value stocks. Let’s take a look at a few individual water-related stocks.

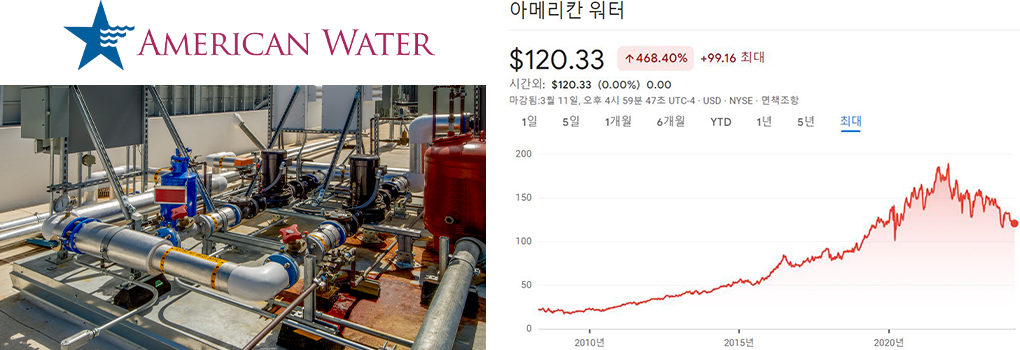

2 American Water Works (AWK)

American Water Works Stock Chart

Source: Google Finance

American Water Works is a public utility company operating in the U.S. and Canada that was established in 1886. It is the largest water and wastewater company in the U.S., supplying water to more than 14 million people in 14 states and 18 military facilities. It also has subsidiaries managing wastewater treatment systems. Listed on the U.S. stock exchange in 1947, this company’s stock is held by 180 ETFs, making it highly popular. Recently, it received the 2023 WaterSense Excellence Award from the U.S. Environmental Protection Agency (EPA) and was ranked 18th on the 2023 list of the 100 most sustainable U.S. companies. Public utility facilities have high entry barriers, making it difficult for competing companies to emerge rapidly. Regular replacement of aging water and wastewater pipes and treatment equipment is necessary. With large-scale water pipe replacement projects planned across the vast North American continent, this company is expected to continue to steadily execute projects into the future.

3 Waters Corporation (WAT)

Waters Corporation Stock Chart

Source: Google Finance

Waters Corporation is an analytical laboratory instrument and software company specializing in measuring not only the water we drink but also a variety of food and beverages, alcoholic drinks, cosmetics, and environmental samples from rivers and oceans. Particularly noted for its high analytical capability, it can accurately and precisely measure even trace elements, making it an indispensable partner in the healthcare industry. Contaminants are ubiquitous, and every manufacturing sector has a Quality Control (QC) department, suggesting a broad customer base. To detect trace contaminants, periodic upgrades of equipment are inevitable, as customers and investors will choose only companies with sufficient technological capabilities.

4 K-Water’s Green Bonds

Let’s now examine a case from Korea. The Korea Water Resources Corporation (K-Water) has issued green bonds to fund projects for aging water pipe measurement, expansion of metropolitan water supply, and industrial water supply. Green bonds are special bonds issued solely for financing of environmentally friendly projects. Driven by the recent ESG trend, the demand for green bonds in the financial market has risen, leading K-Water to twice issue green bonds in the Swiss market. Each issuance attracted orders amounting to more than five times the available bonds, highlighting its popularity. As the leading company in domestic renewable energy, primarily hydroelectric power, and a comprehensive water specialist pushing forward the 2050 carbon neutrality roadmap in the water sector, K-Water’s ESG management has undoubtedly been a significant advantage. Although the accessibility for individual investors may be somewhat limited due to institutions snapping up these bonds, the green bond market, now in its 15th year and maturing, is expected to expand from government and public institutions to the private sector, growing in size and perhaps offering opportunities for us as well.

However, not all investments magically yield profits. Investments in water also are subject to interest rates, exchange rates, and global issues. Therefore, investing in water requires a long-term perspective and a relaxed approach. Simply put, the profits “flow slowly and naturally like a calm river.” Rather than expecting quick returns, view such investment instead as an opportunity to steadily increase your assets.

#OUTRO

In the following episode, we will explore how companies like ours that include water in their products — namely cosmetics, beverages, and alcoholic drinks — utilize the theme of “water” in their marketing strategies. I will share how they have transformed the transparent resource into a golden opportunity and hit two targets with one arrow: sustainability and commerciality. You can look forward to it!

P.S.: This manuscript aims only to provide information about water and is not intended as investment advice.

-

Like

1 -

Recommend

1 -

Thumbs up

1 -

Supporting

1 -

Want follow-up article

1